All over the mainstream media today, the wealthy are being pitted against the poor. Those advocating for the wealthy claim that if we could just cut the taxes for the rich and make things easier for them that they will create lots of jobs for the rest of us. Those advocating for the poor claim that the gap between the rich and the poor is now larger than ever and that if we could just get the workers to fight for their rights that we could get things back to how they used to be. It is a very interesting debate, but it totally ignores a reality that is even more important. America’s economic pie is rapidly shrinking. As part of the new globalist economy, every single month massive amounts of U.S. wealth is being transferred out of the United States and into foreign hands in exchange for oil and cheap plastic trinkets. In addition, every single month our national government goes into more debt, our state governments go into more debt and our local governments go into more debt. The interest on all of this debt represents a tremendous transfer of wealth. What most Americans fail to grasp is that our collective wealth is getting smaller. There is now less of an “economic pie” for all of us to divide up.

All over the mainstream media today, the wealthy are being pitted against the poor. Those advocating for the wealthy claim that if we could just cut the taxes for the rich and make things easier for them that they will create lots of jobs for the rest of us. Those advocating for the poor claim that the gap between the rich and the poor is now larger than ever and that if we could just get the workers to fight for their rights that we could get things back to how they used to be. It is a very interesting debate, but it totally ignores a reality that is even more important. America’s economic pie is rapidly shrinking. As part of the new globalist economy, every single month massive amounts of U.S. wealth is being transferred out of the United States and into foreign hands in exchange for oil and cheap plastic trinkets. In addition, every single month our national government goes into more debt, our state governments go into more debt and our local governments go into more debt. The interest on all of this debt represents a tremendous transfer of wealth. What most Americans fail to grasp is that our collective wealth is getting smaller. There is now less of an “economic pie” for all of us to divide up.

When it comes to economics, most people have a presupposition that the United States will always be getting wealthier. But that is completely and totally wrong. The truth is that we have been steadily getting poorer over the last several decades, and now we are bleeding national wealth at such a pace that it is almost unimaginable.

All over the country tremendous economic pain is starting to set in, and tens of millions of people are getting very angry. Americans are lashing out at both political parties, at their employers and at each other, but the reality is that the vast majority of them simply do not understand why all of this is happening. They just want to be told that someone is working to “fix” the problem with the economy and that things will get back to “normal” soon.

But things are not going to be getting back to “normal”. Please follow along as I explain many of the reasons why America’s economic pie is rapidly shrinking….

#1 The Biggest Transfer Of Wealth In The History Of The World

Every single month tens of billions of dollars of our national wealth is transferred to the rest of the world. We buy far more from the rest of the globe than they buy from us, and this difference is called a trade deficit. Most Americans don’t even think about the trade deficit, but the truth is that it represents a transfer of wealth that is almost unimaginable.

Every month when the oil-exporting nations of the Middle East send us oil, what do we send to them? Our dollars of course. So we burn up their oil in our vehicles and end up with nothing at the end of the month, and they end up with a big pile of our money. So what happens the next month? The exact same process repeats again.

But it is not just oil-exporting nations that we are transferring our national wealth to. Back in 1985, the U.S. trade deficit with China was 6 million dollars for the entire year. For this past August alone, the trade deficit with China was over 28 billion (that’s billion with a “b”) dollars.

In other words, the U.S. trade deficit with China in August was more than 4,600 times larger than the U.S. trade deficit with China was for the entire year of 1985.

That is why China has so much money to lend back to us – we have been transferring tens of billions of dollars of our national wealth to them month after month after month.

#2 That Great Sucking Sound You Hear Is Our Jobs Leaving The Country

The big global corporations that now dominate our economy have realized that they don’t really need to hire “expensive” American workers after all. When all of these “free trade agreements” (which are neither “free” nor “fair”) were being debated, the American people were not told that they were going to be merged into one huge global labor pool and that they would soon be directly competing for jobs with the cheapest workers in the world. Today there are hordes of laborers on the other side of the globe that will gladly work for less than 10 percent of what a typical blue collar American worker makes.

So can American workers compete with that? Well, just look at what is happening. The jobs are flying out of this country. In fact, the United States has lost a staggering 32 percent of its manufacturing jobs since the year 2000.

But it just isn’t jobs at the low end of the scale that are being lost. Since the year 2000, we have lost 10% of our middle class jobs. In the year 2000 there were about 72 million middle class jobs in the United States but today there are only about 65 million middle class jobs.

The truth is that now there are not nearly enough jobs to go around. Just check out the average duration of unemployment in America – it is now way, way above historical norms….

#3 Unemployed Workers Do Not Create Wealth

When U.S. workers are forced to sit on the sidelines, they drain wealth instead of creating it. At a time when millions of American workers should be involved in creative economic activity, they are collecting food stamps and unemployment checks instead.

One out of every six Americans is now enrolled in a federal anti-poverty program. As 2007 began, 26 million Americans were on food stamps, but now 42 million Americans are on food stamps and that number keeps rising every single month.

The rest of the American people are going to support all of these unemployed and underemployed workers somehow. Either we are going to provide them with good jobs, or we are going to have to pay for their food stamps and welfare checks.

#4 The National Economic Infrastructure Is Being Destroyed

Proponents of the emerging one world economy talk about how great it is to have so many really inexpensive products, but they don’t realize what the hidden costs are. The truth is that the United States is rapidly becoming deindustrialized.

Since 2001, over 42,000 U.S. factories have closed down for good. Meanwhile, hordes of shiny new factories are going up in places like China and India.

Sacrificing our economic infrastructure for cheap foreign imports is kind of like tearing off pieces of your house just so you can keep the fire going. Eventually, you simply are not going to have much of a house left.

#5 The Government Is Absolutely Exploding In Size, And Government Workers Produce Relatively Little Wealth

It seems like the federal government keeps exploding in size no matter who we elect. George W. Bush was supposed to be a “conservative”, but the truth is that the U.S. government grew in size more under him than during any other presidency.

But there is a big economic problem when it comes to big government. It costs a ton to run, but it produces relatively little of economic value.

Just how much is this big federal government costing us? Well, the total compensation that the U.S. government workforce is going to take in this year is approximately 447 billion dollars.

Not only that, but according to a recent study conducted by the Heritage Foundation, federal workers earn 30 to 40 percent more money on average than their counterparts in the private sector.

The U.S. economy would be much better off if the federal government was dramatically reduced in size and large numbers of government workers started doing something that actually created substantial economic value instead.

#6 Military Spending – Trying To Police The World Is Draining Us Dry

Many people claim that military spending is good for the economy because it provides lots of jobs. However, the truth is that when you examine what those jobs are actually producing, you quickly realize that they are not creating real wealth. Instead, they are just feeding a war machine that is designed to kill people and blow things up.

Now, the truth is that we will always need a powerful military and a strong national defense. But trying to police the world is absolutely draining our national resources.

At this point, it is estimated that the U.S. government has spent over 373 billion dollars on the war in Afghanistan, and over 745 billion dollars on the war in Iraq.

Not only that, today the U.S. military has over 700 bases (some say it is actually over 1000 bases) in 130 different countries around the globe. It is estimated that it costs about $100 billion a year to maintain these bases.

All of this money may or may not be making us safer, but it is undeniable that it is not going to create wealth and economic activity here at home.

#7 America Is Getting Sicker And It Is Draining Our Wealth

The American people are not going to be creating wealth if they are constantly sick all the time. The truth is that the toxins in the food that we eat, in the stuff that we drink and in the air that we breathe are destroying our health.

According to one recent report, the United States has dropped to 49th place in the world in overall life expectancy.

49th place?

Diseases such as cancer, heart disease and diabetes are absolutely exploding. This may be good for the “medical industry”, but how in the world are we supposed to work hard and create wealth if all of us are sick all the time?

#8 The U.S. National Debt Nightmare

Thirty years ago, the U.S. national debt was about 1 trillion dollars. Today, it is rapidly approaching 14 trillion dollars.

Every single year, hundreds of billions of dollars in interest on that debt gets transferred from U.S. taxpayers to the owners of that debt. We get absolutely nothing in return for these interest payments. They are a pure transfer of wealth.

Many of the owners of this debt are international bankers or foreign governments that never reinvest the dollars they are getting back into our system.

#9 The Municipal Debt Bubble

When you bring up the term “government debt”, most Americans only think of the debt of the federal government. But the truth is that there are literally hundreds of state and local government debt implosions happening all across the United States.

As you read this, state and local government debt is now sitting at an all-time high of 22 percent of U.S. GDP. All of these state and local loans must be serviced, and the interest costs on them are substantial. Once again, all of these interest payments (mostly going to international bankers and foreign governments) represent pure transfers of wealth.

#10 America’s Addiction To Debt

Debt is literally draining this country dry. Just as with federal debt and municipal debt, consumer debt is a tremendous drain on our wealth. For example, if you put a $500 television on your credit card but then you eventually pay back $2000 to the bank because of interest and fees, who is getting rich and who is being drained?

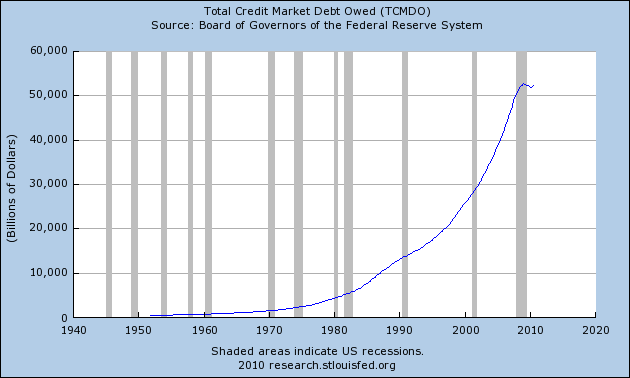

Posted below is a chart that shows the growth of total credit market debt over the last several decades. When you add up all forms of debt in the United States (government debt + business debt + consumer debt), it comes to over 50 trillion dollars. In fact, total credit market debt now sits at approximately 360 percent of GDP. It is the biggest debt bubble in the history of the world….

So who does all of this debt benefit? It benefits the international bankers and foreign governments that are becoming insanely wealthy from all of the interest that all of this debt is generating.

Could you imagine just getting a small slice of the interest that over 50 trillion dollars of debt is generating?

When you look at the chart above, it is easy to grasp why life has been so “good” over the last thirty years. We have been enjoying a debt-fueled binge of historic proportions and it has been a lot of fun.

But now a day of reckoning is at hand and our national wealth is being funneled out of our hands at a pace that is almost unimaginable.

When wealth gets transferred out of our hands, that means that the “economic pie” that we all get to divide up becomes smaller. As it continues to shrink, large numbers of Americans are going to become increasingly angry and increasingly desperate.

Unfortunately, the problems that we are facing took decades to develop and they simply cannot be turned around overnight. In fact, our problems continue to get even worse every single month.

It is time to wake up and realize that the “good times” are coming to an end. Please share this article with your family and friends. Most Americans have no idea that our nation is getting poorer and that our economy is literally falling apart.

When the system finally does collapse like a house of cards, the vast majority of Americans will never even see it coming. Very hard times are coming and now is the time to get prepared.