For years, people have been laughing at the horrific economic decline of Detroit. Well, guess what? The same thing that happened to Detroit is now happening to dozens of other communities across the United States. From coast to coast there are formerly great manufacturing cities that have turned into rotting, post-industrial war zones. In particular, in America’s “rust belt” you can drive through town after town after town that resemble little more than post-apocalyptic wastelands. In many U.S. cities, the “real” rate of unemployment is over 30 percent. There are some communities that will start depressing you almost the moment you drive into them. It is almost as if all of the hope has been sucked right out of those communities. (Read More...)

For years, people have been laughing at the horrific economic decline of Detroit. Well, guess what? The same thing that happened to Detroit is now happening to dozens of other communities across the United States. From coast to coast there are formerly great manufacturing cities that have turned into rotting, post-industrial war zones. In particular, in America’s “rust belt” you can drive through town after town after town that resemble little more than post-apocalyptic wastelands. In many U.S. cities, the “real” rate of unemployment is over 30 percent. There are some communities that will start depressing you almost the moment you drive into them. It is almost as if all of the hope has been sucked right out of those communities. (Read More...)

12 Simple Things You Can Start Doing Right Now To Prepare For The Coming Financial Apocalypse

It is becoming increasingly apparent that the U.S. economy is heading for complete and total disaster. State and local governments across the nation are uncontrollably bleeding red ink. The federal government has accumulated the largest debt in world history. Every year we buy hundreds of billions of dollars more from the rest of the world than they buy from us. That means that we are getting hundreds of billions of dollars poorer as a nation every single year. Meanwhile, thousands of factories and millions of jobs continue to be sent overseas as American cities turn into post-industrial wastelands. Incomes are down, unemployment remains at depressingly high levels and very few of our politicians seem to have any idea how to fix things. Yes, things are really, really bad. So what are some things that we can all be doing to prepare for the coming financial apocalypse? (Read More...)

It is becoming increasingly apparent that the U.S. economy is heading for complete and total disaster. State and local governments across the nation are uncontrollably bleeding red ink. The federal government has accumulated the largest debt in world history. Every year we buy hundreds of billions of dollars more from the rest of the world than they buy from us. That means that we are getting hundreds of billions of dollars poorer as a nation every single year. Meanwhile, thousands of factories and millions of jobs continue to be sent overseas as American cities turn into post-industrial wastelands. Incomes are down, unemployment remains at depressingly high levels and very few of our politicians seem to have any idea how to fix things. Yes, things are really, really bad. So what are some things that we can all be doing to prepare for the coming financial apocalypse? (Read More...)

Obama’s Mistakes: 12 Examples That Show That Just About Everything That Barack Obama Tries To Do Turns Out Badly

Why does it seem like virtually everything that Barack Obama tries to do turns out badly? There is a reason why his approval rating has fallen so precipitously. Whether you agree with his policies or not, it is getting hard to deny that he is having a really hard time getting anything done right. Health care reform was a total disaster, the economy continues to get worse, foreign policy is an unmitigated mess and faith in the federal government is at an all-time low. Some Democrat insiders are now wondering if Barack Obama is actually losing it. There are even whispers that Barack Obama may be challenged for the Democratic nomination in 2012. That still seems far-fetched at this point, but without a doubt it is not just Republicans that are wondering about Barack Obama’s competence at this point. (Read More...)

Why does it seem like virtually everything that Barack Obama tries to do turns out badly? There is a reason why his approval rating has fallen so precipitously. Whether you agree with his policies or not, it is getting hard to deny that he is having a really hard time getting anything done right. Health care reform was a total disaster, the economy continues to get worse, foreign policy is an unmitigated mess and faith in the federal government is at an all-time low. Some Democrat insiders are now wondering if Barack Obama is actually losing it. There are even whispers that Barack Obama may be challenged for the Democratic nomination in 2012. That still seems far-fetched at this point, but without a doubt it is not just Republicans that are wondering about Barack Obama’s competence at this point. (Read More...)

The 12 Stupidest Ideas That Anyone Has Ever Come Up With To Fight Global Warming

Today, some of the “top scientists in the world” are coming up with some really, really dumb ideas for fighting climate change. First of all, the theory of man-made global warming is currently falling apart like a 20 dollar suit because it never was backed up by solid scientific evidence, but even if it was true what some of these scientists are proposing to do to stop it is absolutely crazy. Some of the ideas being proposed are fairly harmless such as putting giant mirrors in space or filling up our oceans with millions of tons of Special K. However, some of the other ideas being floated by prominent scientists are incredibly frightening. There are scientists that are now openly proposing strict population control measures and the forced relocation of human populations. They believe such proposals are necessary “for the good of the planet”, but the truth is that what they are suggesting quickly conjures up images of the worst totalitarian regimes that the earth has ever seen. (Read More...)

Today, some of the “top scientists in the world” are coming up with some really, really dumb ideas for fighting climate change. First of all, the theory of man-made global warming is currently falling apart like a 20 dollar suit because it never was backed up by solid scientific evidence, but even if it was true what some of these scientists are proposing to do to stop it is absolutely crazy. Some of the ideas being proposed are fairly harmless such as putting giant mirrors in space or filling up our oceans with millions of tons of Special K. However, some of the other ideas being floated by prominent scientists are incredibly frightening. There are scientists that are now openly proposing strict population control measures and the forced relocation of human populations. They believe such proposals are necessary “for the good of the planet”, but the truth is that what they are suggesting quickly conjures up images of the worst totalitarian regimes that the earth has ever seen. (Read More...)

Americans Are Willing To Trample One Another To Get Their Hands On Cheap Foreign-Made Plastic Crap Even As The United States Turns Into A Post-Industrial Wasteland

As this latest Black Friday clearly demonstrated, Americans are literally willing to trample one another to get the best deals on cheap foreign-made plastic crap. Meanwhile, as thousands of factories and millions of jobs continue to get shipped overseas, the United States is rapidly turning into a post-industrial wasteland. Once great manufacturing cities such as Camden, New Jersey have become crime-ridden, gang-infested hellholes. In some U.S. cities, the “real” unemployment rate is around 30 or 40 percent. The American people desperately need jobs, but the American people are also showing no signs that they plan to give up their addiction to cheap foreign goods. Our politicians keep insisting that the American people just need “more education” and “more skills” in order to compete, but they don’t ever seem to explain how more education and more skills are going to make new jobs pop into existence out of thin air. The truth is that the American Dream is rapidly becoming the American Nightmare and there is not much hope that any of this is going to turn around any time soon. (Read More...)

As this latest Black Friday clearly demonstrated, Americans are literally willing to trample one another to get the best deals on cheap foreign-made plastic crap. Meanwhile, as thousands of factories and millions of jobs continue to get shipped overseas, the United States is rapidly turning into a post-industrial wasteland. Once great manufacturing cities such as Camden, New Jersey have become crime-ridden, gang-infested hellholes. In some U.S. cities, the “real” unemployment rate is around 30 or 40 percent. The American people desperately need jobs, but the American people are also showing no signs that they plan to give up their addiction to cheap foreign goods. Our politicians keep insisting that the American people just need “more education” and “more skills” in order to compete, but they don’t ever seem to explain how more education and more skills are going to make new jobs pop into existence out of thin air. The truth is that the American Dream is rapidly becoming the American Nightmare and there is not much hope that any of this is going to turn around any time soon. (Read More...)

Vladimir Putin’s Vision Of A Socialist European Free Trade Zone That Stretches From The Atlantic To The Pacific

Back during the Cold War, one of the great fears was that the Soviet Union would invade western Europe and absorb it into their socialist empire. But now could essentially that exact same thing happen in the name of free trade? Over the past couple of decades, the European Union has gone from being just a “free trade area” to a highly repressive socialist regime run by a bunch of control freaks. As many in Europe have correctly noted, the European Union is highly centralized, deeply corrupt and almost entirely undemocratic – just like the former Soviet Union. Now Russian Prime Minister Vladimir Putin is publicly proposing that all of Europe should join with Russia to create an absolutely gigantic “free trade zone” that would stretch from the Atlantic to the Pacific. (Read More...)

Back during the Cold War, one of the great fears was that the Soviet Union would invade western Europe and absorb it into their socialist empire. But now could essentially that exact same thing happen in the name of free trade? Over the past couple of decades, the European Union has gone from being just a “free trade area” to a highly repressive socialist regime run by a bunch of control freaks. As many in Europe have correctly noted, the European Union is highly centralized, deeply corrupt and almost entirely undemocratic – just like the former Soviet Union. Now Russian Prime Minister Vladimir Putin is publicly proposing that all of Europe should join with Russia to create an absolutely gigantic “free trade zone” that would stretch from the Atlantic to the Pacific. (Read More...)

Home Sales Drop Once Again

Existing home sales in the U.S. are down again. New home sales in the U.S. are down again. What else is new? The U.S. housing industry just cannot seem to bounce back. Mortgage lenders have really, really tightened up lending standards and so now there are a lot fewer qualified buyers than there used to be. It is as if the big financial institutions have nearly shut off the flow of credit. But without credit, the vast majority of American families don’t have a prayer of achieving the American Dream of owning a home. Even with mortgage rates close to record lows the housing market is still languishing. Unfortunately, it doesn’t matter how low mortgage rates are if American families can’t get home loans approved. With unemployment still staggeringly high and with incomes still declining, it appears that the U.S. housing market is going to continue to suffer for some time to come. (Read More...)

Existing home sales in the U.S. are down again. New home sales in the U.S. are down again. What else is new? The U.S. housing industry just cannot seem to bounce back. Mortgage lenders have really, really tightened up lending standards and so now there are a lot fewer qualified buyers than there used to be. It is as if the big financial institutions have nearly shut off the flow of credit. But without credit, the vast majority of American families don’t have a prayer of achieving the American Dream of owning a home. Even with mortgage rates close to record lows the housing market is still languishing. Unfortunately, it doesn’t matter how low mortgage rates are if American families can’t get home loans approved. With unemployment still staggeringly high and with incomes still declining, it appears that the U.S. housing market is going to continue to suffer for some time to come. (Read More...)

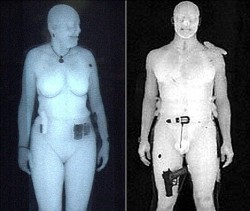

22 Incredibly Revealing Quotes About Enhanced Pat Downs And TSA Groping

At what point will Americans finally stop losing more liberty and freedom? With each passing year, the iron grip of the government gets even tighter, and each time it does we are told that it is either for “our safety” or for “national security”. One can only imagine what is going to happen the next time there is any kind of “terror incident” on an airplane. They are going to point to all those Americans who are complaining about “enhanced pat downs” and TSA groping as the reason why security is not tough enough. So where does all this end? Will we eventually all have to go through a body cavity search just to get on an airplane? Will they start groping us at school, at work and at sporting events? Are we going to have to “lock down” America from coast to coast to ensure that no terrorist ever is able to harm any American? (Read More...)

At what point will Americans finally stop losing more liberty and freedom? With each passing year, the iron grip of the government gets even tighter, and each time it does we are told that it is either for “our safety” or for “national security”. One can only imagine what is going to happen the next time there is any kind of “terror incident” on an airplane. They are going to point to all those Americans who are complaining about “enhanced pat downs” and TSA groping as the reason why security is not tough enough. So where does all this end? Will we eventually all have to go through a body cavity search just to get on an airplane? Will they start groping us at school, at work and at sporting events? Are we going to have to “lock down” America from coast to coast to ensure that no terrorist ever is able to harm any American? (Read More...)