Once thousands of nanobots are zipping around inside your body, will you still be in control of your mind, will and emotions or will the nanobots be running the show? According to Google, a nanobot is “a hypothetical, very small, self-propelled machine, especially one that has some degree of autonomy and can reproduce”. Scientists here in the United States have been working on nanobots that can travel through our bodies at astonishing speeds, deliver medicines to targeted locations, and even enter our brain cells. Eventually, researchers hope to use nanobots to connect our brains directly to the Internet. I realize that all of this sounds quite crazy, but as you will see below, everything that I am sharing with you has been documented. (Read More...)

Rampant Poverty And Rampant Homelessness Are Fueling Rampant Theft And Rampant Violence In Major U.S. Cities

The tremendous chaos that is gripping communities all over this country did not emerge out of a vacuum. For years, poverty and homelessness have been on the rise. According to a recent report from Harvard University, the number of homeless Americans has increased by almost 50 percent in less than a decade. Meanwhile, the ranks of the poor have been growing as the middle class has been eroding. Today, approximately 40 percent of the entire U.S. population is considered to be either living in poverty or among the “working poor”. According to Wikipedia, the bottom 50 percent of the U.S. population only has 2.6 percent of the wealth. And that number is from 2021, and so things are almost certainly even worse today. All of this economic suffering is helping to fuel a deeply alarming explosion of theft and violence in our major cities, and our leaders don’t seem to have any solutions. (Read More...)

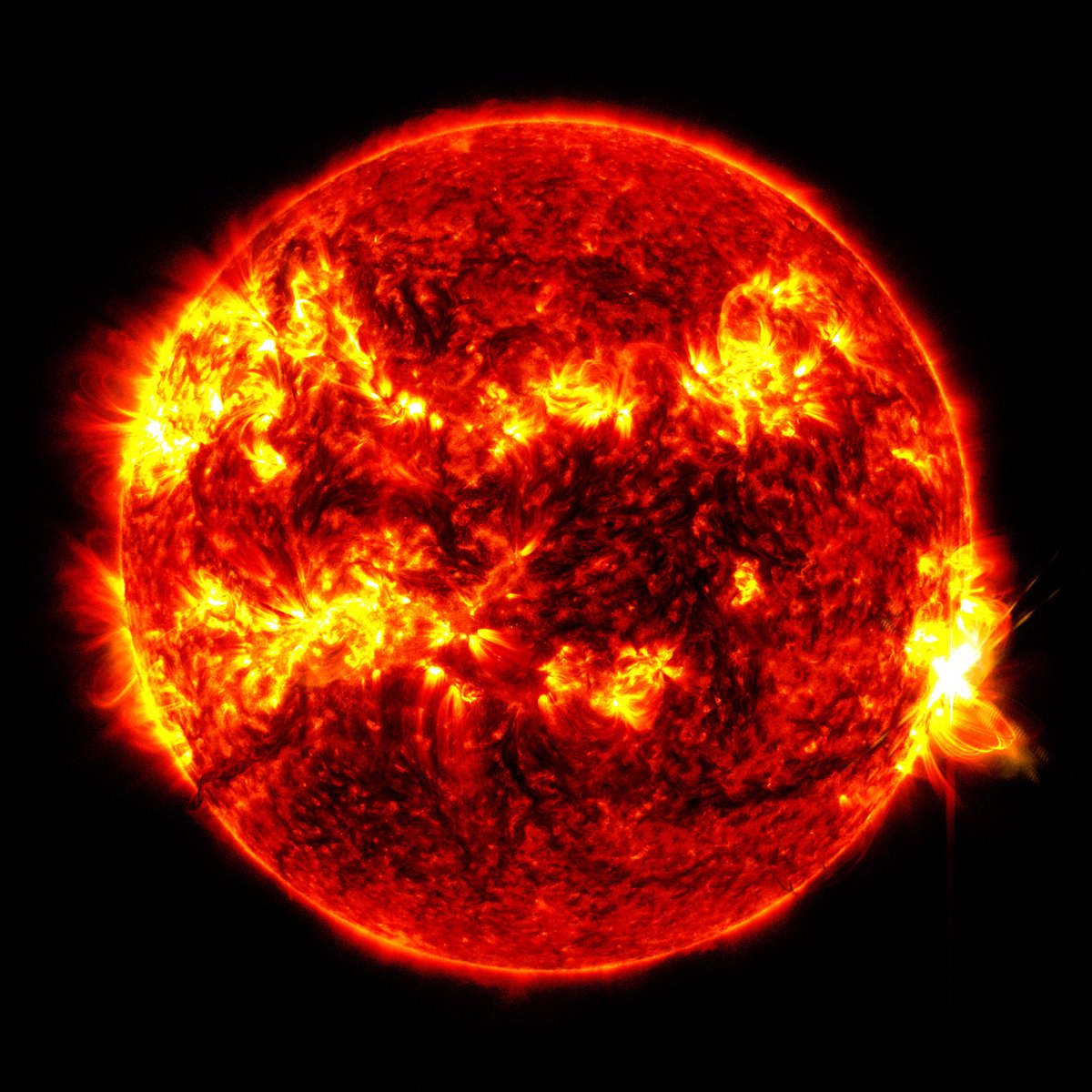

The Sun Is Not Done Yet – Another Absolutely Gigantic “Warning Shot” Was Just Sent Our Way

The sun just unleashed a monstrous X-class flare, and hardly anyone noticed. The X8.7 solar flare that we just witnessed was the largest one of this entire solar cycle. The good news is that it wasn’t a threat to our planet at all. Radio activity was affected in some areas of the globe for a while, but other than that there was no danger. But that doesn’t mean that we shouldn’t be paying attention. As I have been warning my readers, the giant ball of fire that we revolve around has been behaving very erratically in recent years. If solar activity continues to increase, it is just a matter of time before our planet gets hit really hard. (Read More...)

What Is Causing This? “Demographic Winter Is Coming” As Fertility Rates Plummet All Over The Globe

Fertility rates have fallen way below replacement level throughout the entire industrialized world, and this is starting to cause major problems all over the globe. Aging populations are counting on younger generations to take care of them as they get older, but younger generations are not nearly large enough to accomplish that task. Meanwhile, there aren’t enough qualified young workers in many fields to replace the expertise of older workers that are now retiring. Sadly, this is just the beginning. As I discuss in my new book entitled “Chaos”, if fertility rates continue to drop we could potentially be facing an unprecedented global population collapse in the decades ahead. This has become so evident that even the mainstream media is starting to do stories about this. In fact, an economist that was just interviewed by the Wall Street Journal is warning that “demographic winter is coming”… (Read More...)

Russia’s New Invasion Is Targeting Ukraine’s Second Largest City, And That Could Bring Us To The Brink Of “Nuclear Armageddon”

The war in Ukraine has just moved to an entirely new level, but most Americans do not even realize that we are closer to “nuclear Armageddon” than ever. Very early on the morning of May 10th, Russian forces began to pour across Ukraine’s border north of Kharkiv. In the short-term this will enable the Russians to create a buffer zone around the Belgorod region and force Ukraine to pull desperately needed forces away from the eastern front. But eventually I believe that the Russians fully intend to take Kharkiv, and that would be an absolutely devastating blow. Needless to say, losing Ukraine’s second largest city is not an option for Ukraine’s western backers, and they are determined to do whatever it takes to keep that from happening. (Read More...)

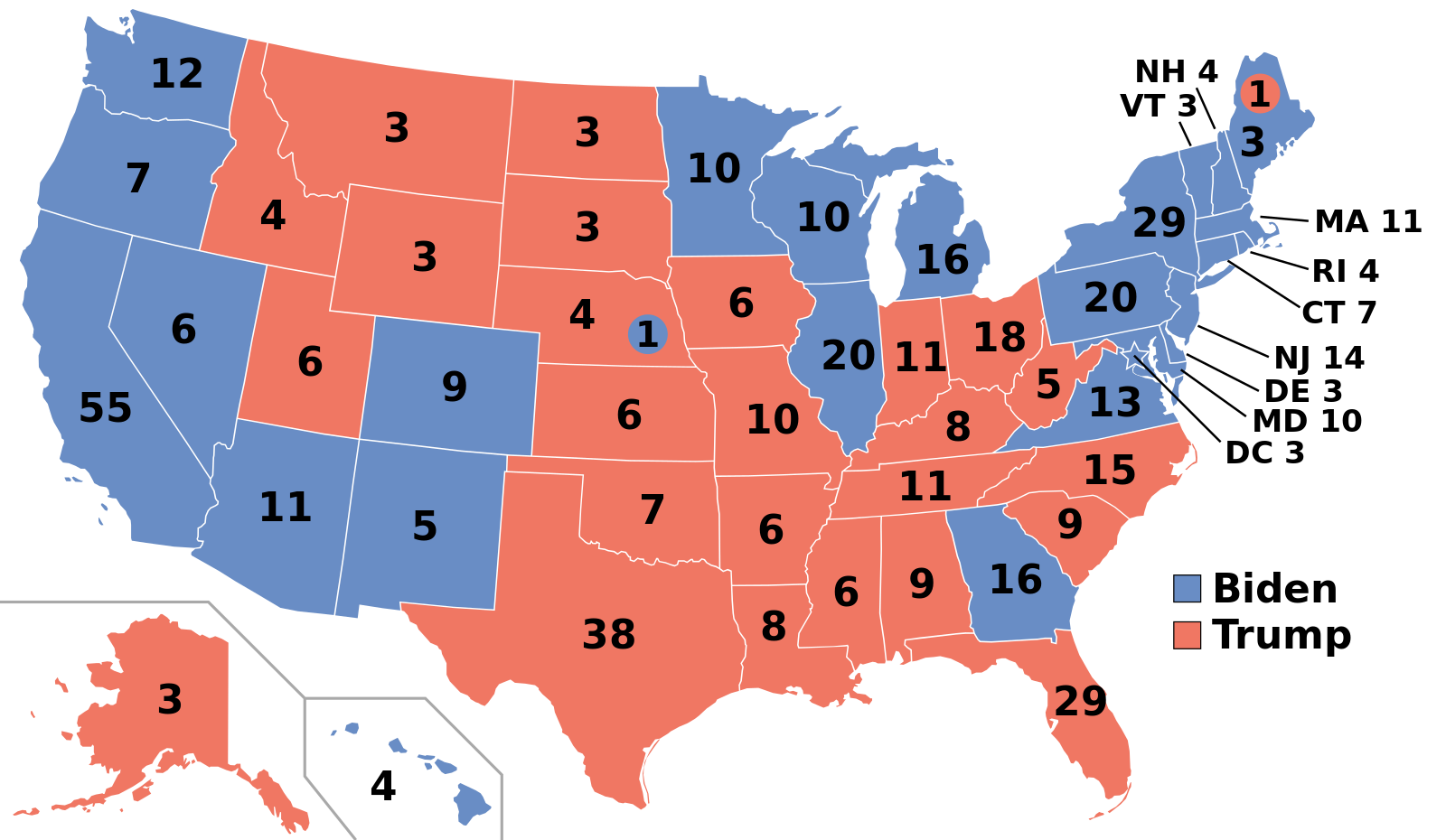

The Mass Exodus To “Red America”

In recent years we have literally seen millions of Americans relocate from blue states to red states. In some cases, there is simply a desire to be around other like-minded people. In other cases, specific political policies that have been enacted in certain states have motivated large numbers of people to relocate. This was particularly true during the pandemic. Of course there are also many that are just trying to escape the crime, drugs, homelessness and violence that are plaguing so many major cities in blue states. For those that are trying to raise a family, finding a safe environment for their children is often of the utmost importance. As a result of the factors that I have just mentioned, we have been witnessing a “mass exodus” to “Red America” that is unlike anything we have ever seen before. Vast numbers of people have been moving from blue states such as California, New York and Illinois to red states such as Florida, Idaho and Montana… (Read More...)

A Red Heifer Sacrifice Is Coming, But The Discovery Of The Ark Of The Covenant Will Be Even More Important

There is a lot of speculation that historic events that people have been anticipating for more than 2,000 years are about to happen in our time. About a month ago, there was a lot of discussion on the Internet about whether or not the sacrifice of the tenth red heifer would take place during the Passover season, and obviously that did not happen. However, I am entirely convinced that a red heifer sacrifice is eventually coming. But if you think that the sacrifice of the tenth red heifer will be big, the truth is that the discovery of the Ark of the Covenant will be even more important. (Read More...)

Can You Guess What It Costs To Live “The American Dream” After 3 Years Of Inflation Under Joe Biden?

If you are like most Americans, the cost of living has been going up much faster than your income has been. Right now, millions of Americans that were once prospering are now deeply struggling. When I was growing up, most of the population could afford to live “the American Dream”, but now that is no longer true. At this point, the basics of a middle class lifestyle are out of reach for most Americans. Poverty and homelessness are steadily rising, and the economy has become the number one issue during this election cycle. Most of us just want things to go back to the way that they once were, but thanks to the very foolish decisions of our leaders that simply is not possible. (Read More...)