Many people have been stumped as they have attempted to find a coherent theme in Barack Obama’s economic policies. But the truth is that what the Obama administration is trying to do is not that difficult to figure out. Just like so many other previous administrations, the Obama administration is motivated by self-preservation. All of Barack Obama’s economic policies are designed to produce a short-term economic burst that will help him win the next election in 2012, and the Federal Reserve has been cooperating every step of the way. Perhaps the Federal Reserve is motivated by self-preservation as well. The American people are becoming extremely disenfranchised with the Federal Reserve, and so those inside the Fed likely realize that they better get the economy on track or face even more scrutiny. In any event, Obama and the Fed are working together to do whatever they can to improve the short-term economic situation. Unfortunately, everything that they are doing is making our long-term economic problems even worse. But Barack Obama and the Federal Reserve are not really concerned with what is going to happen down the road. What the Obama administration and the Federal Reserve are concerned about is protecting their rear ends in the here and now.

Many people have been stumped as they have attempted to find a coherent theme in Barack Obama’s economic policies. But the truth is that what the Obama administration is trying to do is not that difficult to figure out. Just like so many other previous administrations, the Obama administration is motivated by self-preservation. All of Barack Obama’s economic policies are designed to produce a short-term economic burst that will help him win the next election in 2012, and the Federal Reserve has been cooperating every step of the way. Perhaps the Federal Reserve is motivated by self-preservation as well. The American people are becoming extremely disenfranchised with the Federal Reserve, and so those inside the Fed likely realize that they better get the economy on track or face even more scrutiny. In any event, Obama and the Fed are working together to do whatever they can to improve the short-term economic situation. Unfortunately, everything that they are doing is making our long-term economic problems even worse. But Barack Obama and the Federal Reserve are not really concerned with what is going to happen down the road. What the Obama administration and the Federal Reserve are concerned about is protecting their rear ends in the here and now.

So exactly what are some of the things that Barack Obama and the Federal Reserve have been doing that are boosting the economy in the short-term but that are destructive to our economy in the long-term?

Well, the following are just a few examples….

#1 Out Of Control Government Spending

More government spending always stimulates the economy. When the government borrows and spends more money, that puts more cash into the hands of the people and it spurs economic activity.

This is what all of the “stimulus packages” were all about. This is also what the record-setting deficits are all about. If the U.S. government had not wildly spent massive amounts of money over the last couple of years our economic downturn would have been a lot worse.

So if all of this wild borrowing and spending is so good for the economy, then why don’t we do it all the time?

Well, that is what Keynesian economics is all about. Keynesian economics postulates that the government should borrow and spend extra money during economic downturns in order to stimulate the economy.

Unfortunately, over the years our political leaders decided that it was always a good time to stimulate the economy with extra spending and so now we have accumulated the biggest mountain of debt in the history of the world.

Every single penny of debt makes our long-term economic future worse. Every dollar that we borrow and spend now is a dollar that future generations have to pay back later (with interest). We keep running up our national credit card to benefit our short-term economic situation, but now we have reached the point where our long-term economic outlook is absolutely nightmarish.

Right now, our national debt is $14,099,823,671,305.06, and it continues to increase by about 4 billion dollars a day.

But Barack Obama does not care. All he cares about is getting re-elected in 2012. So what Obama wants to do is to keep borrowing and spending wildly so that he can get a short-term economic boost right now.

In fact, Obama was back at it again on Monday.

Speaking in front of 200 members of the U.S. Chamber of Commerce, Obama trumpeted the need to spend a lot more government money on education and infrastructure.

Obama wants to spend as much money as he can right now because he knows that this gives him the very best chance of winning again in 2012.

#2 Tax Cuts

Tax cuts almost always stimulate the economy. They put more cash into the hands of individuals and businesses and this tends to spur economic activity.

Many were surprised when Barack Obama agreed to a tax cut deal with the Republicans, but it all makes sense when you understand what Barack Obama wants.

Barack Obama wants to get re-elected in 2012.

Obama also knows (or should know) that tax cuts will help to stimulate the economy in the short-term.

Unwittingly, the Republicans have actually helped Obama’s chances in 2012 by agreeing to this tax cut deal. Lower taxes can only help the short-term economic situation.

The funny thing about the tax cut deal that Obama and the Republicans agreed to is that most of the tax cuts are to last for only two years.

Yes, just long enough to provide a short-term economic boost through the 2012 presidential campaign.

Of course George W. Bush did the same kind of thing many times.

But aren’t tax cuts good?

Well, yes they generally are. The truth is that the U.S. government already receives far, far, far more money than it should ever need.

But the problem is these tax cuts are not being paid for. Instead, taxes are being cut at a time when all kinds of new government spending is also going on. This is going to lead to a lot more debt, which as we talked about above is a long-term economic problem that threatens to destroy our economy.

#3 Super Low Interest Rates

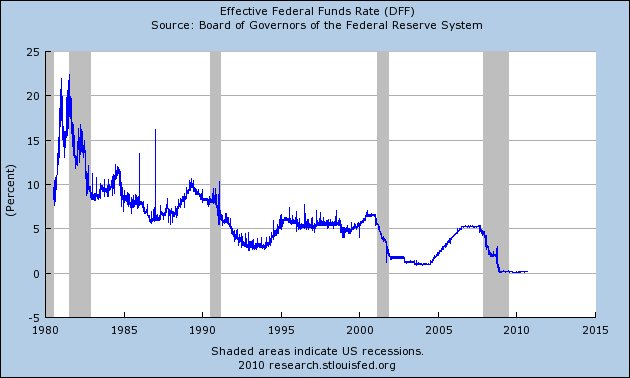

The U.S. Federal Reserve has slashed interest rates to the floor and the folks over at the Fed have kept them there for an extended period of time.

In the past, whenever the Federal Reserve has wanted to stimulate the economy, they have cut interest rates. Well, at this point rates have been shoved all the way to the pavement and they have no way to go lower. Just check out the chart posted below. Talk about pushing it to the red line!….

In the past when the Fed has lowered interest rates this has tended to produce great economic bubbles. For example, the low interest rates during the early years of the past decade helped create the real estate bubble.

So what kind of bubbles are being created by the ultra-low interest rates of today? What is going to happen when they pop?

But Barack Obama and the Federal Reserve want interest rates to stay very low right now because this is going to give the U.S. economy the best chance to turn around, and Obama and the Fed both desperately need some economic improvement right now.

Unfortunately, as we have seen so many times, “easy money now” often leads to very hard lessons later.

#4 Quantitative Easing

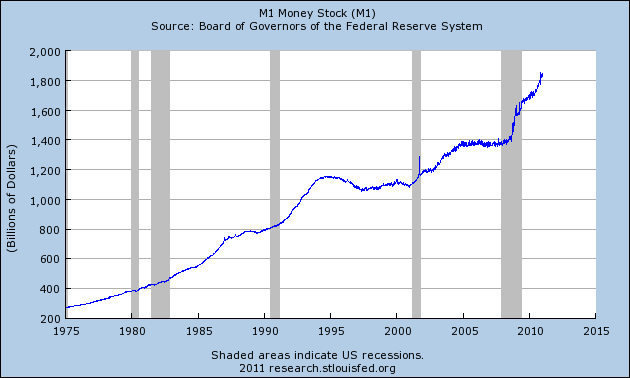

Another way that the Federal Reserve is seeking to stimulate the economy in the short-term is through something called “quantitative easing”. Essentially what the Federal Reserve is doing is that they are creating lots of new money out of thin air and they are pumping it into the financial markets.

This has helped big Wall Street banks to recover. It has also fueled booms in the stock market and in various agricultural commodities.

When the Fed makes money out of nothing and puts it into the hands of bankers that is supposed to stimulate lending. The idea is that more lending will stimulate more economic activity. So far it is not working that well, but that is the idea.

So what is the downside?

Well, the downside is that all of this new money could create a tremendous amount of inflation. Our money supply is growing at a frightening pace. Just check out the chart posted below….

Whenever a new dollar is introduced into the system, every other dollar in existence loses a little bit of value. Inflation is a hidden tax that affects every single dollar that each of us own.

All of this “new money” will probably stimulate the economy at least to some degree, but in the end the permanent inflation that it will cause will not be worth the short-term benefit.

The Federal Reserve doesn’t seem to care that rising prices for food and gasoline are going to devastate the middle class.

Barack Obama and most of the members of Congress don’t seem to care that all of their reckless spending is stealing the future from our children and grandchildren.

Like most Americans, what Barack Obama and the Federal Reserve really care about is what is going to happen to them right now.

Barack Obama wants a good economy right now so that he can win the next election.

The Federal Reserve wants a good economy so that they can get the American people off of their backs.

Unfortunately, it is all the rest of us that are going to suffer the long-term consequences for their short-term decisions.

But this is what our politicians have been doing to us for decades. Republicans and Democrats have both been ignoring long-term economic consequences when they have been in power. Both parties have sold our children into perpetual debt slavery.

Now all of that short-term thinking and all of that debt is starting to catch up with us. The U.S. middle class is being absolutely ripped to shreds and there are not nearly enough jobs for everyone. We are living in the greatest debt bubble in the history of the world, and all of that debt is a crushing load that is sucking the life out of our economy.

It would be nice to say that there is hope for the future, but with people like Barack Obama and Ben Bernanke running things that simply would not be the truth. In fact, the top levels of government in this nation seem to be absolutely riddled with incompetents.

Both political parties are deeply corrupt and both of them have sold us out.

Our financial future has been destroyed and at this point about the best our leaders can do is to “kick the can down the road” for as long as they possibly can.

An economic disaster of truly historic proportions is on the horizon and it is headed our way.

You better get ready.