Interest rates have nowhere to go but up. Interest rates will rise during the second half of 2010, and they will continue to rise during 2011. This is going to cause a lot of pain for the U.S. economy and for American consumers. Unfortunately, this is not just the opinion of a handful of half-baked Internet nutjobs. This is the assessment of the New York Times and of the highly respected economists that they interviewed. It seems that virtually everyone in the financial community agrees that it is inevitable that interest rates are going to rise. And that is really bad news for the U.S. economy.

Interest rates have nowhere to go but up. Interest rates will rise during the second half of 2010, and they will continue to rise during 2011. This is going to cause a lot of pain for the U.S. economy and for American consumers. Unfortunately, this is not just the opinion of a handful of half-baked Internet nutjobs. This is the assessment of the New York Times and of the highly respected economists that they interviewed. It seems that virtually everyone in the financial community agrees that it is inevitable that interest rates are going to rise. And that is really bad news for the U.S. economy.

So why are interest rates going to rise?

Well, there are lots of reasons that the financial experts give. One of the key factors often cited is the exploding U.S. national debt. The U.S. government needs to borrow more money and so do most of the state governments, so there is more competition than ever to borrow money in the marketplace.

Another factor often cited is the “frightening prospect of inflation” and what it could do to the U.S. economy if it is not controlled. And the U.S. will experience horrific inflation levels at some point – just not yet.

In addition, many analysts point to the decision by the Federal Reserve to halt its emergency $1.25 trillion program to buy mortgage debt as another factor that is putting upward pressure on interest rates.

However, the main reason interest rates are going to go up is because that is what the financial “powers that be” have decided must be done. After all, do you think they were going to keep lending super cheap money to all of us forever? Especially when so many of us are defaulting on our homes and credit cards?

It just wasn’t going to happen.

When risks go up so must interest rates.

Any financial institution that keeps loaning money at very low rates and that also experiences a high rate of defaults is eventually going to find itself in a whole lot of trouble.

The problem is that a whole generation of Americans have shaped their lifestyles around easy credit at historically low interest rates. But interest rates are as low as they can go. Interest rates just cannot stay at the super low levels that we have seen over the past couple of years.

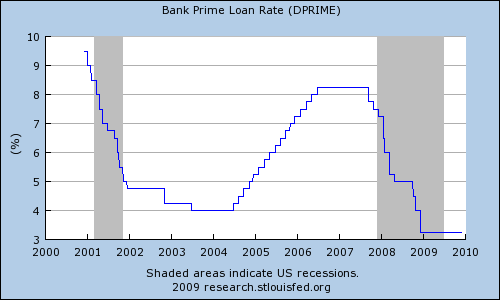

The following chart is just one illustration of how ridiculously low interest rates have been for the past few years….

In fact, Americans have enjoyed an environment of generally declining interest rates since 1981. But that era is over according to most analysts. Now the roller coaster is about to go back up. At least that is what Bill Gross told the New York Times….

“Americans have assumed the roller coaster goes one way,” said Bill Gross, whose investment firm, Pimco, has taken part in a broad sell-off of government debt, which has pushed up interest rates. “It’s been a great thrill as rates descended, but now we face an extended climb.”

So what are higher interest rates going to mean for you and I?

Economic pain.

Living the American Dream is about to become a whole lot more expensive.

If you have an adjustable mortgage, get ready to pay higher mortgage payments. Already rates have started to jump. According to Freddie Mac’s weekly survey of conforming mortgage rates, the 30-year fixed-rate mortgage reached an 8-month high last week, averaging 5.21 percent. And unfortunately, the Mortgage Bankers Association expects the rise of mortgage rates to continue. In fact, they project that the 30-year mortgage rate will be at 5.5 percent by the end of the summer and they are projecting that it will be somewhere around 6 percent by the end of 2010.

If you are planning to buy a car, get ready for higher monthly payments. Higher interest rates mean that you won’t be able to afford as much car as you did before. According to the Federal Reserve, rates at auto finance companies are already rising. They hit 4.72 percent in February compared with just 3.26 percent in December 2009.

If you have an adjustable student loan, you could be in for quite a shock in the months ahead. Higher interest rates could dramatically affect your monthly student loan payments.

In addition, get ready for higher credit card bills. The Federal Reserve says that the average interest rate on credit cards reached 14.26 percent in February, which was the highest mark since 2001. Many analysts are projecting that number will go as high as 16 or 17 percent by the end of the year.

Needless to say, now is the time to get out of debt. Many consumers who are already overleveraged are going to be absolutely swamped when higher interest rates hit them. Any loan with an adjustable rate is going to become a lot more painful. New loans are going to become much more costly. Now is the time to get out of debt and avoid getting into new debt.

So what will higher interest rates do to the U.S. economy?

Well, higher rates will likely tank it of course.

Especially the housing market.

“Mortgage rates are unlikely to go lower than they are now, and if they go higher, we’re likely to see a reversal of the gains in the housing market,” Christopher J. Mayer, a professor of finance and economics at Columbia Business School, told the New York Times. “It’s a really big risk.”

So how much will higher interest rates affect the housing market?

Well, according to Mayer, an increase of just 1 percentage point in the interest rate of a mortgage will add approximately19 percent to the total cost of a house.

Ouch.

Can you afford to pay 20 percent more for your house?

But that is what many people are going to face.

If the New York Times is to be believed, it is inevitable that interest rates are going to increase substantially….

No one expects rates to return to anything resembling 1981 levels. Still, for much of Wall Street, the question is not whether rates will go up, but rather by how much.

This is yet another indication that the U.S. economy is going to be facing some tough times ahead. On a personal level, it is more imperative than ever to get out of debt and stay out of debt. Debt is about to become really expensive. You don’t want to be handing big chunks of your paycheck over in interest payments when you could be using it to provide for your family.

When you see dark clouds on the horizon you know a storm is coming.

In the same way, when all of the top financial analysts agree that interest rates are going to rise, you know that economic trouble is brewing.

Now is the time to prepare.