Even as sales of new homes in the United States plunge to the lowest level on record and even as confidence among U.S. consumers falls to dramatic new lows, it is coming out that bonuses for Wall Street executives and Fortune 500 CEOs are larger than ever. In fact, it is at some of the firms that received the most U.S. government assistance during the bailouts that executives are getting some of the biggest bailouts. So exactly how are the rest of us supposed to feel when millions of Americans are desperately suffering financially while executives at firms that were bailed out by the U.S. government are swimming in bonus cash? Should we be glad that at least a few fatcats are enjoying the American Dream while the rest of us suffer?

Even as sales of new homes in the United States plunge to the lowest level on record and even as confidence among U.S. consumers falls to dramatic new lows, it is coming out that bonuses for Wall Street executives and Fortune 500 CEOs are larger than ever. In fact, it is at some of the firms that received the most U.S. government assistance during the bailouts that executives are getting some of the biggest bailouts. So exactly how are the rest of us supposed to feel when millions of Americans are desperately suffering financially while executives at firms that were bailed out by the U.S. government are swimming in bonus cash? Should we be glad that at least a few fatcats are enjoying the American Dream while the rest of us suffer?

We were all told over and over that Wall Street had to be bailed out in order for Main Street to recover.

Well, it turns out that Main Street is hurting more than ever while Wall Street executives are overflowing with cash.

For example, New York state Comptroller Thomas DiNapoli said on Tuesday that Wall Street bonuses for 2009 were up 17 percent when compared with 2008. Seeing that figure you would think that these are boom times for the U.S. economy.

But these aren’t boom times. Millions of Americans are still losing their homes and their jobs. And yet even companies that are laying off American workers are rewarding their executives with massive amounts of cash. A year ago, General Motors was on the verge of bankruptcy. They are still in very, very bad shape, and yet the CEO of General Motors is in line to get a $9 million pay package.

Nobody at General Motors is worth 9 million dollars.

The truth is that if they wanted to get their financial house in order, the first thing they should do is stop handing out giant bags of cash to executives who haven’t earned it.

Even troubled insurance firm AIG (which had to go to the Feds for multiple bailouts) is handing out tens of millions of dollars in bonuses to their executives.

Does that seem right to you?

Does it feel good to know that piles of U.S. taxpayer cash are being used to pay bonuses to a bunch of AIG executives?

The truth is that whenever the U.S. economy experiences a downturn, it is always the poor and the working class that get hurt the most.

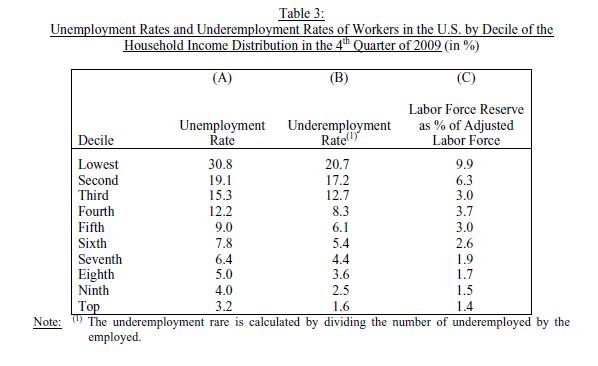

That is particularly true this time around. Just consider the chart posted below. The unemployment rate for Americans as the lowest end of the income spectrum is about ten times higher than for those Americans at the highest end of the income spectrum….

The truth is that the rich are getting richer and the poor are taking the brunt of this economic downturn.

The truth is that the rich are getting richer and the poor are taking the brunt of this economic downturn.

All of the bailouts didn’t do much to help average Americans. Millions are losing their jobs and their homes and the U.S. government is not going to do anything to bail them out.

But those poor bankers and Fortune 500 executives were showered with hundreds of billions of dollars in bailouts when they whined and complained.

Now many of those same people are rolling around in massive piles of bonus cash.

So who is going to pay the bill for all of those bailouts?

The American people.

And yet the U.S. government continues to waste money at a dizzying pace.

For example, the U.S. government has unveiled plans for a new $1 billion high-security embassy in London – the most expensive embassy the U.S. has ever built.

It even features a 100 foot wide moat.

Isn’t that wonderful?

But all of this reckless spending and all of this debt is ruining the American Dream for future generations. The financial crimes of this generation will reverberate for decades.

But right now most Wall Street bankers and Fortune 500 executives could pretty much care less. They got their massive piles of bonus cash and if it hurts someone else down the road who really cares?