If you actually believe that it is just a “coincidence” that anti-Israel protests have “spontaneously” erupted at dozens of colleges and universities all over the nation, you are just being delusional. As you will see below, these protests are being organized by paid professional agitators, and they are being funded by the same far left sources that have funded other radical protest movements in the past. But don’t just take my word for it. New York City Mayor Eric Adams is a far left mayor in a far left city, and even he is admitting that there were “professionals” involved in the chaos that we just witnessed at Columbia University… (Read More...)

The Strain Of The Bird Flu That Is Killing Cats In Texas Is Causing “Brain Hemorrhaging” And “Blindness”

The information that I am about to share with you is very alarming. According to the College of Veterinary Medicine at Cornell University, even though there are some minor differences “feline lungs are structured just like human lungs, operate in the same way, and serve the same purpose.” So the fact that H5N1 has been able to spread into the “lungs, brains, hearts, and eyes” of more than 20 cats in Texas is not a good sign at all. According to the CDC, some of the cats that caught H5N1 at one farm in Texas ended up blind… (Read More...)

What Are They Not Telling Us About The Bird Flu?

What they are telling us about the bird flu just keeps changing. At first, they told us that humans were at no risk. But now the WHO says that there is “enormous concern” that H5N1 could potentially start spreading among humans. And when dairy cows in the U.S. started catching bird flu, we were assured that milk from infected cows was being kept out of the supply chain. So most Americans continued to buy milk, cheese and butter as usual. But now two different rounds of testing have confirmed that massive amounts of milk from infected dairy cows is getting into the supply chain. In fact, on Thursday an update that was posted on the official FDA website openly admitted that approximately one out of every five samples of grocery store milk that they tested had “viral fragments” in them… (Read More...)

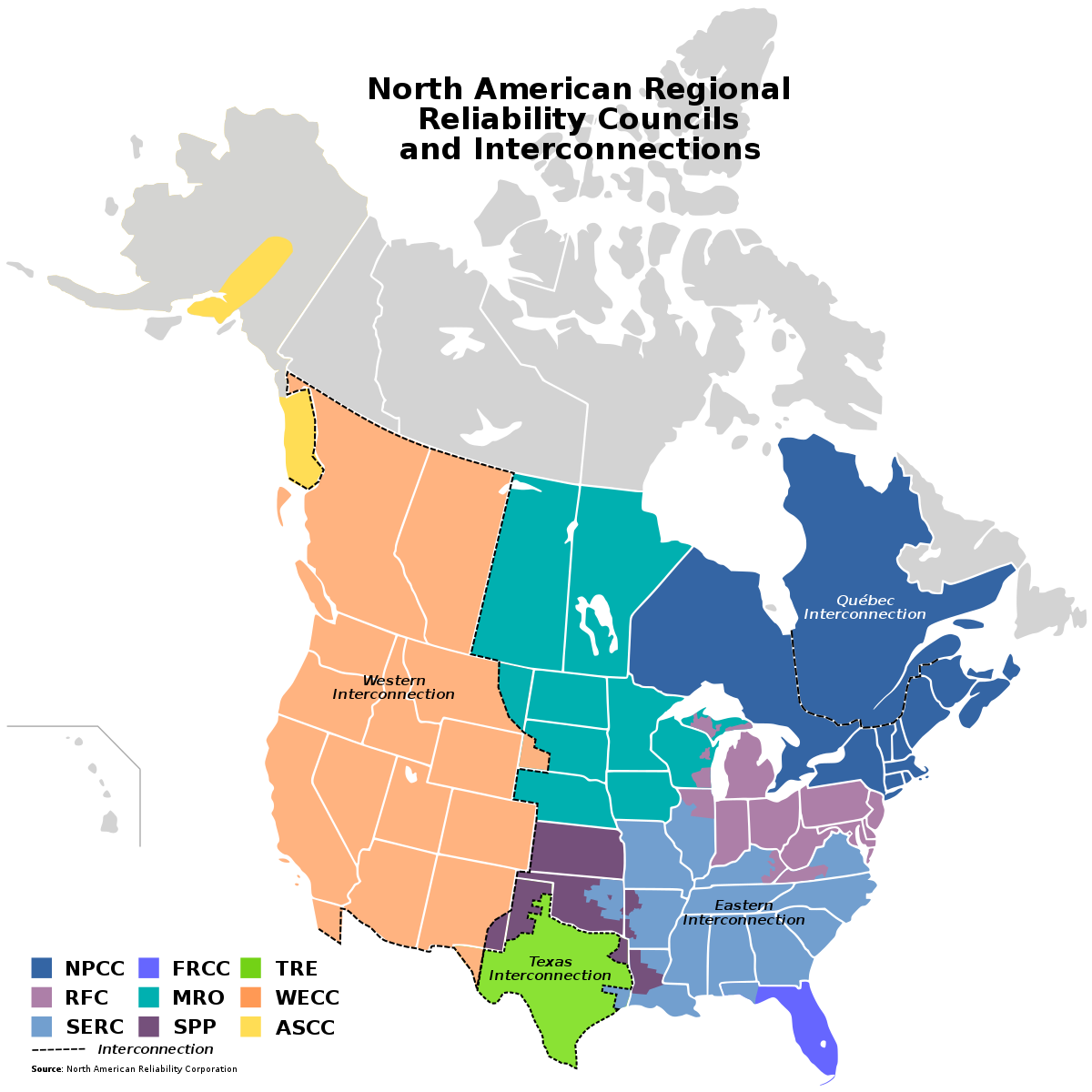

This Is Why Everyone Needs To Prepare For The Day When Devastating Cyberattacks Take U.S. Power Grids Down

What would you do if the power grid where you live went down and there was no electricity for an extended period of time? You might want to think about that, because experts are warning that it is just a matter of time before cyberattacks successfully cripple our power grids. In fact, foreign hackers are working hard to infiltrate critical infrastructure as you read this article. As you will see below, we are extremely vulnerable, and the Russians and the Chinese have both developed highly advanced cyberwarfare capabilities. When the U.S. ends up fighting a war with Russia or China (or both simultaneously), devastating cyberattacks on our power grids will be conducted. When your community is suddenly plunged into darkness, what is your plan? (Read More...)

Which Major City Will Completely Collapse First – Los Angeles, Chicago Or New York City?

In 2024, virtually all major U.S. cities have certain things in common. First of all, if you visit the downtown area of one of our major cities you are likely to see garbage, human excrement and graffiti all over the place. As you will see below, some of our core urban areas literally look like they belong in a third world country. Most of our politicians don’t seem too concerned about doing anything to clean up all the filth, and so it shouldn’t be a surprise that rat populations are absolutely exploding all over the country. In some of our largest cities, the total rat population is numbered in the millions. Meanwhile, rampant theft, out of control violence, endless migration, predatory gangs and the worst drug crisis in the entire history of our nation have combined to create a “perfect storm” of social decay that is unlike anything that any of us have ever seen before. Millions of law-abiding citizens and countless businesses have been fleeing America’s largest cities, and property values in our core urban areas have been absolutely crashing. We really are in the early stages of a full-blown societal “collapse”, and things just keep getting worse with each passing day. (Read More...)

There Is More To This Current Bird Flu Panic Than Meets The Eye

Why are global health officials issuing such ominous warnings about the bird flu? Do they know something that the rest of us do not? H5N1 has been circulating all over the planet for several years now, and it has been the worst outbreak that the world has ever seen. Hundreds of millions of birds are already dead, and now H5N1 has been infecting mammals with alarming regularity. The good news is that so far it has not been a serious threat to humans, but could that soon change? According to the World Health Organization, the possibility that H5N1 could start spreading among humans is an “enormous concern”… (Read More...)

Why Are They Trying So Hard To Convince Us That People That Are Seeing Black-Eyed Demon Faces Have A “Disorder”?

If you came into contact with someone with a face that looked like a demon and eyes that were completely black as night, what would you do? Encounters of this nature are popping up on social media at the exact same time that the mainstream media is trying really hard to convince all of us that anyone that is seeing black-eyed demon faces has a “disorder”. In fact, if you type “demon face” into Google News, you will literally get hundreds of articles about a disorder known as prosopometamorphopsia. But this is a very, very rare disorder. At this point, less than 100 cases of PMO have ever been documented. (Read More...)

Alert! Israel Is Preparing To Hit Iran “Forcefully” And The Iranians Are Promising To Retaliate

This is the most dangerous moment that we have seen in the Middle East in modern times. As you will see below, Israel has decided to hit Iran. There is still debate about whether it should be a devastating blow or a more limited strike. But in either case, the Iranians are pledging to retaliate. In fact, the Iranians are promising to respond to any attack with overwhelming force. Needless to say, that would certainly provoke another response from Israel. The cycle would continue until someone finally decides that enough is enough. But what if neither side backs down and the conflict escalates to an unthinkable level? (Read More...)