For more than a billion people living in China, freedom of religion does not exist. So those that do wish to worship as they please must do it in secret, and if they are discovered the consequences can be extremely severe. This week, China is in the news because it is suddenly engaged in a massive trade war with the United States. But most of the time, people living in the western world don’t pay much attention to what is really going on inside China, and so very few actually know about the absolutely horrifying things that are being done to Christians by the communist Chinese government. (Read More...)

8 Signs That The Bombing Of Iran Could Be Coming Very Soon

If bombs start falling on Iran’s nuclear facilities, it would instantly be the biggest news story of 2025 so far. Iranian air defenses would need to be neutralized first, and that would be quite an extensive operation all by itself. Subsequently, destroying Iran’s nuclear facilities would be extraordinarily difficult, because many of them are very deep underground. We have heard a lot about our “bunker buster” bombs, but there is a lot of debate about whether those bombs can actually destroy facilities that are buried that deep. Of course the moment the Iranians start getting bombed, they will strike back by hitting Israeli cities and U.S. bases all over the Middle East. At that point we would be at war with the Iranians, and there would be no turning back. The following are 8 signs that the bombing of Iran could be coming very soon… (Read More...)

1930s Dust Bowl Conditions Are Returning To The Middle Of The United States

Absolutely gigantic dust storms are “triggering massive highway pileups” in the middle of the country, virtually the entire Southwest is currently experiencing at least some level of drought, and dust storms and soil erosion are now costing our economy more than 100 billion dollars every year. If you think that what we are witnessing is “normal”, you simply are not being rational. The same conditions that prevailed during the Dust Bowl years of the 1930s are returning, and scientists have warned us that the megadrought that has now begun could continue for a long time to come. (Read More...)

This May Not Be What They Were Originally Anticipating, But A “Reset” Of The Global Economy Is Definitely Here

Over the past few years, there has been a tremendous amount of buzz about an imminent “reset” of the global economy. Well, what we are currently witnessing may not look like what they were anticipating, but a “reset” of the global economy is definitely here. Trillions of dollars were invested to set up the global supply chains that we have today. I have always argued that we should have never allowed ourselves to become so dependent on goods that are made elsewhere, and making more things in this country is a goal that every administration should pursue. Unfortunately, you can’t just reverse decades of investment and construct entirely new supply chains overnight. For example, it costs approximately 10 billion dollars to build a manufacturing facility that makes computer chips, and construction time can run between 3 and 5 years. So anyone that thinks that we can just hit a “reset button” and magically make things better is simply being unrealistic. (Read More...)

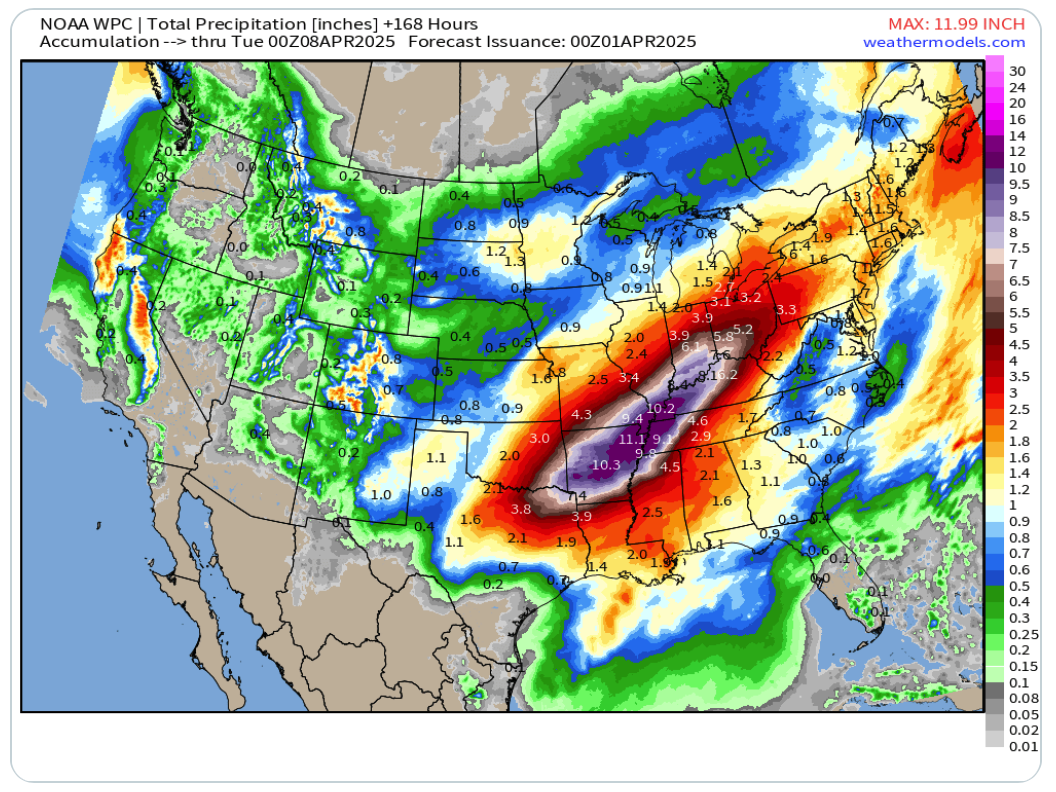

76 Trillion Gallons Of Water Is Expected To Fall On The U.S. During Yet Another “Once In A Generation” Storm. This Is Perfectly Normal.

Four months of rain is about to fall in five days in some areas in the middle of the country. We are being told that an atmospheric river will produce a “firehose of moisture” that is expected to dump 76 trillion gallons of water on the heartland of America over the next week. This is perfectly normal, or so they keep telling us. Western Kentucky, parts of Missouri, northwestern Tennessee, much of Arkansas, southern Indiana and southern Illinois are supposed to get hit the hardest. Overall, 32 million people currently live in areas where a flood watch is now in effect. (Read More...)

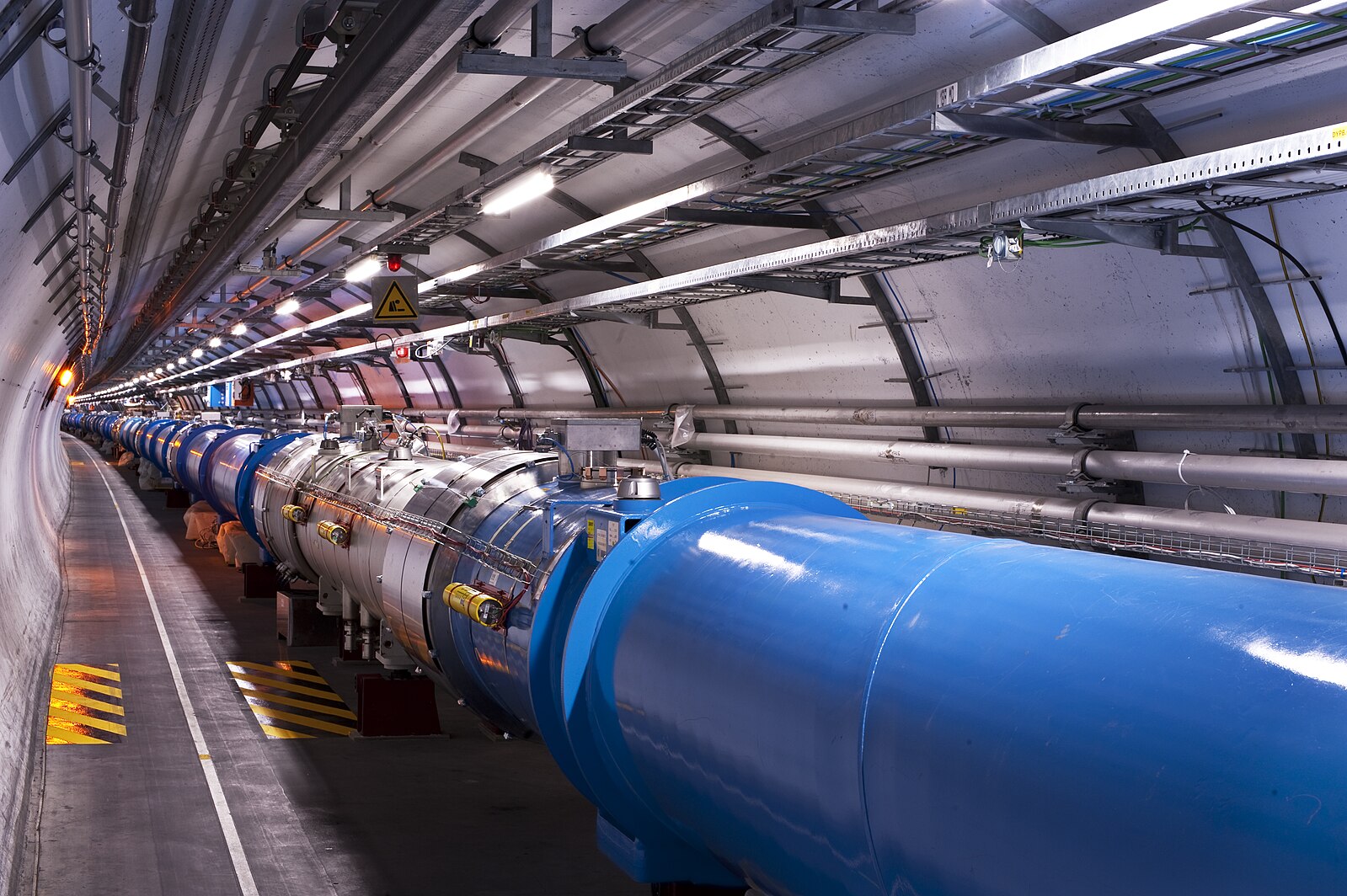

They Want To Create “Spare Human Bodies” And A Version Of The Large Hadron Collider That Is 3 Times Larger

So many of the major problems that our world has had to deal with in recent years have been caused by mad scientists doing things that they should not be doing. Unfortunately, the global scientific community continues to show no restraint whatsoever. The things that I am about to share with you in this article are deeply disturbing. But even though many of us are voicing our objections, they simply do not care. Mad scientists are going to just go ahead and do whatever they want, but if something goes wrong it is the rest of us that will suffer the consequences. (Read More...)

Has A Biological Weapon That Causes People To “Cough Up Blood” Been Released Inside Russia?

It is being reported that an unknown disease that causes people to “cough up blood” has spread to multiple cities in Russia. When I first heard reports that this was happening, I wasn’t sure what to make of it. But now more media outlets are reporting on this mystery disease, and the new reports that I am seeing are extremely alarming. Of course it is entirely possible that this is a naturally occurring illness, but since Russia is involved in a very bitter war with Ukraine we cannot ignore the possibility that some sort of a biological agent has been released inside Russia. Since the U.S. has been very heavily involved in running the war in Ukraine from the very beginning, will the U.S. be blamed if the Russians ultimately determine that a biological weapon of some sort has been used? (Read More...)

An Internal Revolution Started By The Communists

Everyone knew that there would be violence once Donald Trump returned to the White House. He has been the most demonized man in America for the past eight years, and there are a lot of people out there that have deeply internalized the propaganda that has been relentlessly pounded into their heads. At this point, there is no president in the entire history of our country that the left hates more than Donald Trump. Just the mere thought of him can provoke uncontrollable rage in many leftists. So it was inevitable that there would be violence, and I am entirely convinced that what we have experienced so far is just the beginning of a tsunami of civil disorder. (Read More...)