Over the past few years, there has been a tremendous amount of buzz about an imminent “reset” of the global economy. Well, what we are currently witnessing may not look like what they were anticipating, but a “reset” of the global economy is definitely here. Trillions of dollars were invested to set up the global supply chains that we have today. I have always argued that we should have never allowed ourselves to become so dependent on goods that are made elsewhere, and making more things in this country is a goal that every administration should pursue. Unfortunately, you can’t just reverse decades of investment and construct entirely new supply chains overnight. For example, it costs approximately 10 billion dollars to build a manufacturing facility that makes computer chips, and construction time can run between 3 and 5 years. So anyone that thinks that we can just hit a “reset button” and magically make things better is simply being unrealistic. (Read More...)

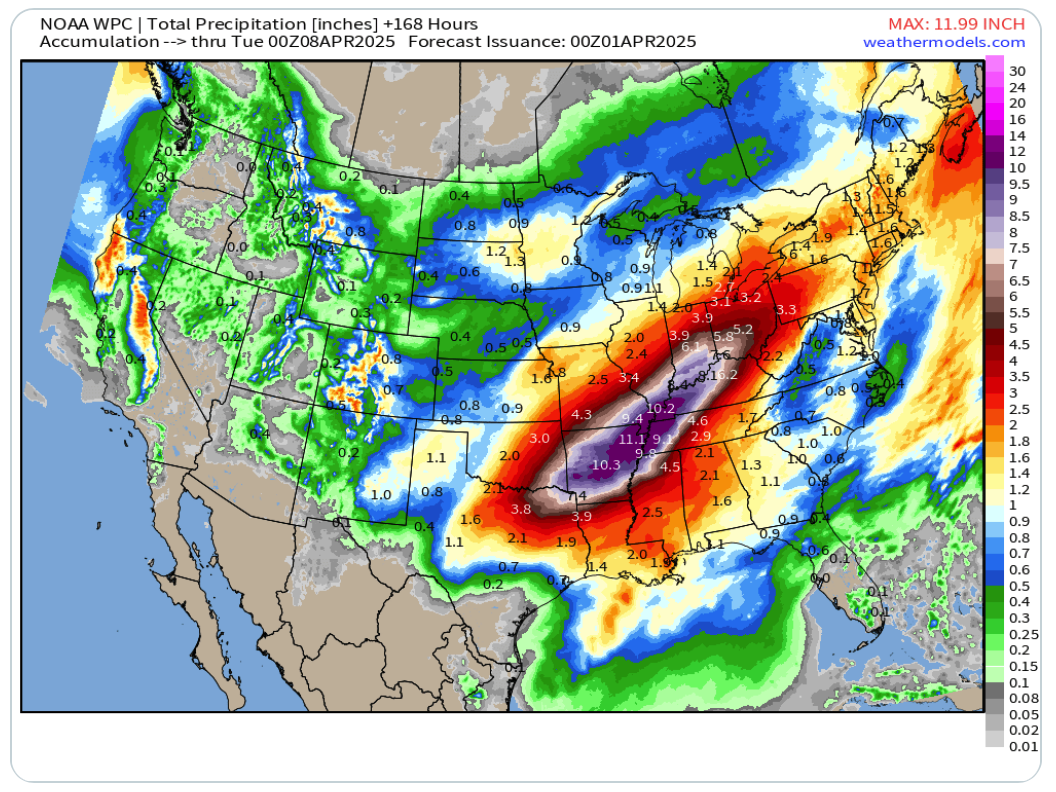

76 Trillion Gallons Of Water Is Expected To Fall On The U.S. During Yet Another “Once In A Generation” Storm. This Is Perfectly Normal.

Four months of rain is about to fall in five days in some areas in the middle of the country. We are being told that an atmospheric river will produce a “firehose of moisture” that is expected to dump 76 trillion gallons of water on the heartland of America over the next week. This is perfectly normal, or so they keep telling us. Western Kentucky, parts of Missouri, northwestern Tennessee, much of Arkansas, southern Indiana and southern Illinois are supposed to get hit the hardest. Overall, 32 million people currently live in areas where a flood watch is now in effect. (Read More...)

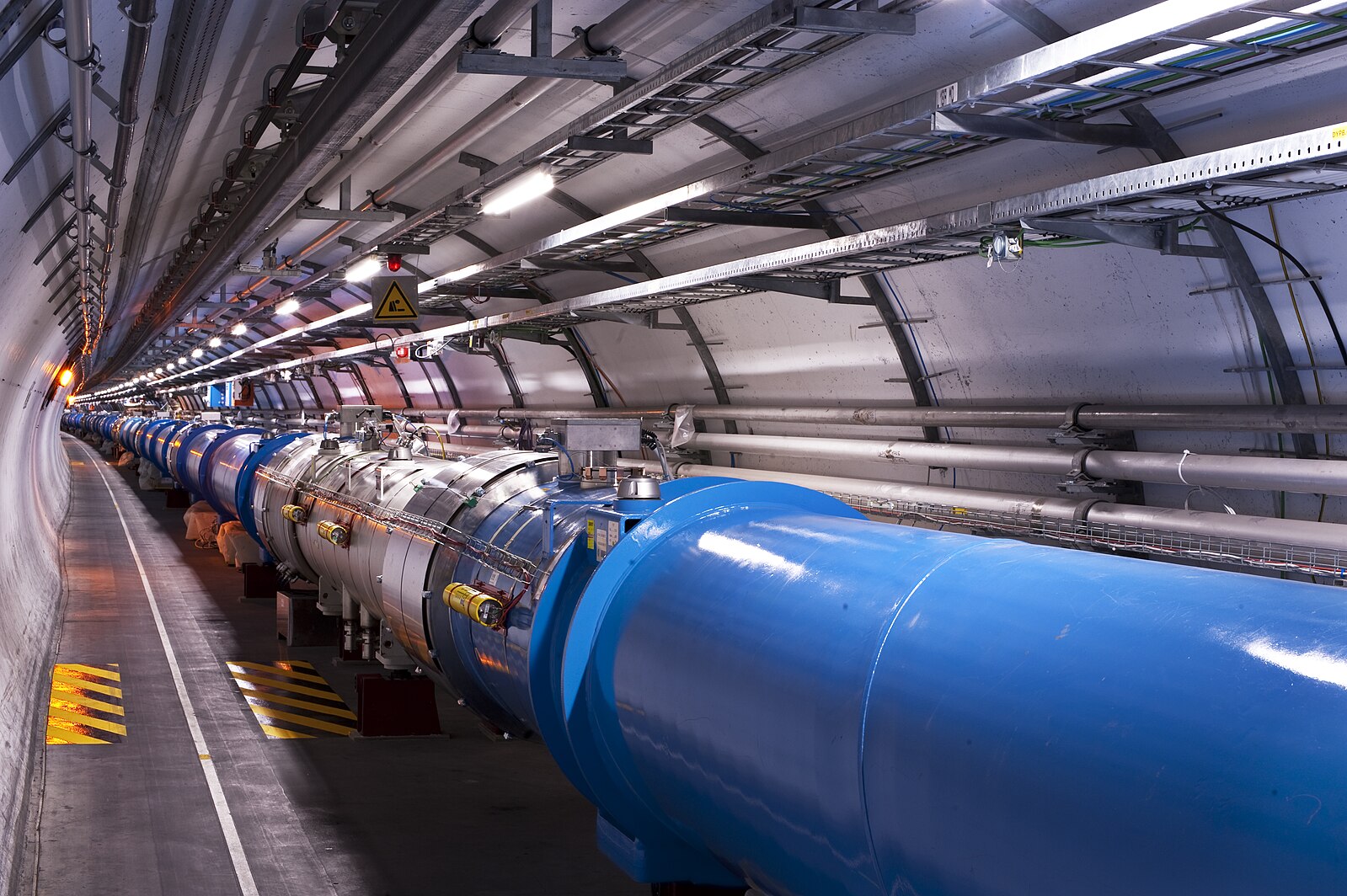

They Want To Create “Spare Human Bodies” And A Version Of The Large Hadron Collider That Is 3 Times Larger

So many of the major problems that our world has had to deal with in recent years have been caused by mad scientists doing things that they should not be doing. Unfortunately, the global scientific community continues to show no restraint whatsoever. The things that I am about to share with you in this article are deeply disturbing. But even though many of us are voicing our objections, they simply do not care. Mad scientists are going to just go ahead and do whatever they want, but if something goes wrong it is the rest of us that will suffer the consequences. (Read More...)

Has A Biological Weapon That Causes People To “Cough Up Blood” Been Released Inside Russia?

It is being reported that an unknown disease that causes people to “cough up blood” has spread to multiple cities in Russia. When I first heard reports that this was happening, I wasn’t sure what to make of it. But now more media outlets are reporting on this mystery disease, and the new reports that I am seeing are extremely alarming. Of course it is entirely possible that this is a naturally occurring illness, but since Russia is involved in a very bitter war with Ukraine we cannot ignore the possibility that some sort of a biological agent has been released inside Russia. Since the U.S. has been very heavily involved in running the war in Ukraine from the very beginning, will the U.S. be blamed if the Russians ultimately determine that a biological weapon of some sort has been used? (Read More...)

An Internal Revolution Started By The Communists

Everyone knew that there would be violence once Donald Trump returned to the White House. He has been the most demonized man in America for the past eight years, and there are a lot of people out there that have deeply internalized the propaganda that has been relentlessly pounded into their heads. At this point, there is no president in the entire history of our country that the left hates more than Donald Trump. Just the mere thought of him can provoke uncontrollable rage in many leftists. So it was inevitable that there would be violence, and I am entirely convinced that what we have experienced so far is just the beginning of a tsunami of civil disorder. (Read More...)

If Everything Is Going To Be Okay, Why Are The U.S. And The EU Feverishly Preparing For World War III?

If there is going to be peace in the Middle East, why has the Pentagon sent 25 percent of our entire fleet of B-2 stealth bombers to the region? And if there is going to be peace in Europe, why is the European Union telling all of their citizens to store up food and water for a war with Russia? We keep being told that everything is going to be okay, but meanwhile western officials continue to make moves that indicate that more war is coming. (Read More...)

8 Things That The Mainstream Media Is Being Strangely Quiet About Right Now

The news cycle has become so predictable lately. Corporate media outlets find something that they think the Trump administration has done wrong, and then they pound on it until they find something else that they think the Trump administration has done wrong. In response, conservative media outlets jump on the stories that the corporate media is reporting and vigorously defend the Trump administration. Meanwhile, there are lots of very important stories that are not getting the attention that they truly deserve. (Read More...)

If The U.S. Joins The British Commonwealth, We Will Become The 57th Nation In A Global Alliance Under The Authority Of King Charles

Apparently King Charles plans to formally invite the United States to join the British Commonwealth, and President Trump seems very enthusiastic about it. I don’t know why more people are not talking about this, because joining the British Commonwealth would be an extremely dramatic move. We are being told that if the U.S. were to become a “member state” it would be “largely symbolic”, but is that really true? As you will see below, King Charles is the head of the British Commonwealth, the organization that runs the British Commonwealth is based in London, and the British Commonwealth is committed to a globalist political agenda which includes taking global action to fight climate change. Does the U.S. really want to come under the authority of a worldwide organization that is pushing such an agenda? (Read More...)