President Trump says that we have “a problem with Iran”, and he insists that he is going to be the one to solve that problem. If the Iranians are willing to compromise, there is a chance that we could see a negotiated deal. If the Iranians are not willing to compromise, there will be military action against Iran. The Iranians are prepared to hit back with everything that they have got if their nuclear facilities are attacked, and once that happens there will be no turning back. So there is a lot riding on the negotiations with Iran that began last weekend and that will continue this upcoming weekend. If the negotiations go badly, the course of human history could take an apocalyptic turn very rapidly. (Read More...)

A Conspiracy Theory That Is Being Pushed By The Left Claims That Something Really Big Is Going To Happen On April 20th

Most people on the right have no idea just how crazed many people on the left have become. Right now, a conspiracy theory which claims that President Trump is preparing to declare martial law in the United States is spreading like wildfire on social media. According to that conspiracy theory, a report will be submitted to President Trump on April 20th which will recommend that he should invoke the Insurrection Act to help deal with the border crisis. That would allow U.S. troops to help secure the border, but many leftists are convinced that President Trump will also use U.S. troops to round up political activists and send them to prisons in El Salvador. I realize that this may sound really bizarre to many of you, but this is what many of them actually believe. (Read More...)

33 Shocking Facts That Prove That The Entire U.S. Healthcare Industry Has Become One Giant Money Making Scam

The goal of the healthcare industry in the United States is to take as much money away from you as possible. I truly wish that I was exaggerating, but I am not. Can you guess which nation spends the highest percentage of GDP on healthcare? Without looking it up, you probably already know that it is us. Gigantic pharmaceutical corporations and massively bloated health insurance companies are raking in colossal mountains of cash, and yet the quality of the healthcare that we receive in return is rather quite poor. People living in Albania, Panama and Kuwait have higher life expectancy rates than we do. Residents of Belarus, Cuba and Latvia have lower infant mortality rates than we do. We are the most medicated population on the planet and yet we are also one of the sickest. If the U.S. healthcare system was a country, it would have the 6th largest economy on the entire globe and yet rates of cancer, heart disease and diabetes continue to soar. (Read More...)

Have You Heard About The Absolutely Horrifying Things That Are Being Done To Christians In China?

For more than a billion people living in China, freedom of religion does not exist. So those that do wish to worship as they please must do it in secret, and if they are discovered the consequences can be extremely severe. This week, China is in the news because it is suddenly engaged in a massive trade war with the United States. But most of the time, people living in the western world don’t pay much attention to what is really going on inside China, and so very few actually know about the absolutely horrifying things that are being done to Christians by the communist Chinese government. (Read More...)

8 Signs That The Bombing Of Iran Could Be Coming Very Soon

If bombs start falling on Iran’s nuclear facilities, it would instantly be the biggest news story of 2025 so far. Iranian air defenses would need to be neutralized first, and that would be quite an extensive operation all by itself. Subsequently, destroying Iran’s nuclear facilities would be extraordinarily difficult, because many of them are very deep underground. We have heard a lot about our “bunker buster” bombs, but there is a lot of debate about whether those bombs can actually destroy facilities that are buried that deep. Of course the moment the Iranians start getting bombed, they will strike back by hitting Israeli cities and U.S. bases all over the Middle East. At that point we would be at war with the Iranians, and there would be no turning back. The following are 8 signs that the bombing of Iran could be coming very soon… (Read More...)

1930s Dust Bowl Conditions Are Returning To The Middle Of The United States

Absolutely gigantic dust storms are “triggering massive highway pileups” in the middle of the country, virtually the entire Southwest is currently experiencing at least some level of drought, and dust storms and soil erosion are now costing our economy more than 100 billion dollars every year. If you think that what we are witnessing is “normal”, you simply are not being rational. The same conditions that prevailed during the Dust Bowl years of the 1930s are returning, and scientists have warned us that the megadrought that has now begun could continue for a long time to come. (Read More...)

This May Not Be What They Were Originally Anticipating, But A “Reset” Of The Global Economy Is Definitely Here

Over the past few years, there has been a tremendous amount of buzz about an imminent “reset” of the global economy. Well, what we are currently witnessing may not look like what they were anticipating, but a “reset” of the global economy is definitely here. Trillions of dollars were invested to set up the global supply chains that we have today. I have always argued that we should have never allowed ourselves to become so dependent on goods that are made elsewhere, and making more things in this country is a goal that every administration should pursue. Unfortunately, you can’t just reverse decades of investment and construct entirely new supply chains overnight. For example, it costs approximately 10 billion dollars to build a manufacturing facility that makes computer chips, and construction time can run between 3 and 5 years. So anyone that thinks that we can just hit a “reset button” and magically make things better is simply being unrealistic. (Read More...)

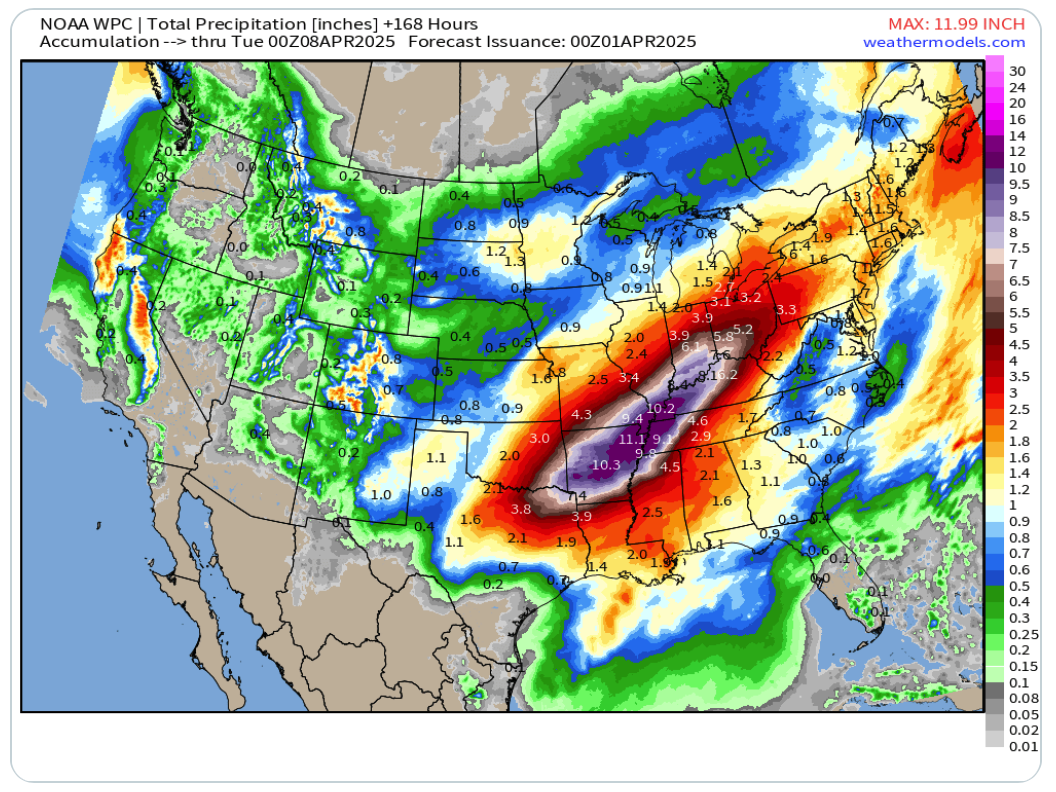

76 Trillion Gallons Of Water Is Expected To Fall On The U.S. During Yet Another “Once In A Generation” Storm. This Is Perfectly Normal.

Four months of rain is about to fall in five days in some areas in the middle of the country. We are being told that an atmospheric river will produce a “firehose of moisture” that is expected to dump 76 trillion gallons of water on the heartland of America over the next week. This is perfectly normal, or so they keep telling us. Western Kentucky, parts of Missouri, northwestern Tennessee, much of Arkansas, southern Indiana and southern Illinois are supposed to get hit the hardest. Overall, 32 million people currently live in areas where a flood watch is now in effect. (Read More...)