Will we see the price of oil rise significantly in 2011? Unfortunately, that appears to be precisely where we are headed. Despite stubbornly high unemployment and a very sluggish economy in the United States, the price of oil continues to creep upward. Part of it can be attributed to the fact that the U.S. dollar and other major currencies are continuing to lose value relative to all commodities, and part of it can be attributed to the continuing rise in the global demand for oil. But those factors alone do not explain what we are seeing. Expectations are a very powerful thing, especially for financial markets, and right now there is an overwhelming consensus that oil prices are going to rise in 2011. The big oil companies, the big oil exporting nations and the big investment banks are nearly all in agreement that a higher price for oil is coming and the speculators smell money and are starting to jump on to the bandwagon.

Will we see the price of oil rise significantly in 2011? Unfortunately, that appears to be precisely where we are headed. Despite stubbornly high unemployment and a very sluggish economy in the United States, the price of oil continues to creep upward. Part of it can be attributed to the fact that the U.S. dollar and other major currencies are continuing to lose value relative to all commodities, and part of it can be attributed to the continuing rise in the global demand for oil. But those factors alone do not explain what we are seeing. Expectations are a very powerful thing, especially for financial markets, and right now there is an overwhelming consensus that oil prices are going to rise in 2011. The big oil companies, the big oil exporting nations and the big investment banks are nearly all in agreement that a higher price for oil is coming and the speculators smell money and are starting to jump on to the bandwagon.

Those who “play the game” in the financial markets are always looking for the next big trend. Right now, a whole lot of people are talking about oil being one of those trends. It is considered to be a “hot” investment for 2011, and unfortunately the underlying economic fundamentals seem to support a higher price for oil.

The following are 9 signs that the price of oil in 2011 will soar well beyond 100 dollars a barrel….

#1 Over the last couple of months, a clear trend of rising oil prices has been established. Crude oil futures for January hit a two-year high of $91.51 a barrel at the end of last week. This represents a 13 percent increase in just the last month.

#2 Usually it is the summer months when we see higher prices for gasoline, but right now gas prices are rising aggressively as we start the winter. The average price of a gallon of gasoline in the United States recently crossed the 3 dollar mark for the first time in more than two years according to AAA’s Daily Fuel Gauge Report. The last time that gas was more than 3 dollars a gallon during the third week of December was in 2007 just months before “the greatest financial crisis since the Great Depression” struck.

#3 The worldwide demand for oil just continues to increase. But unlike previous times, now much of the increase in demand is coming from emerging markets. Did you know that America is not the number one consumer of energy in the world anymore? For about a hundred years the United States used more energy than anyone else, but now the biggest consumer of energy on the globe is China.

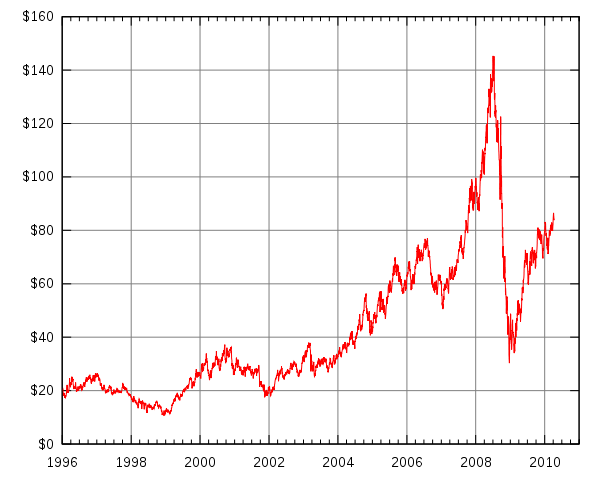

#4 Much of what we are seeing the price of oil do now is simply the continuation of a major upward trend that was interrupted by the financial crash of 2008. Just check out the chart posted below. Clearly the long-term trend for oil is moving up….

#5 Part of the reason why oil is going up is because the value of the dollar is going down. The rest of the world has reacted very negatively to the quantitative easing program initiated by the Federal Reserve, and as the Fed continues to flood the financial system with dollars it is only inevitable that the price of just about everything, including oil, will continue to go up.

#6 The speculators smell money and they are beginning to pour into the market. Speculative longs currently far outnumber speculative shorts. According to the Commodity Futures Trading Commission, long positions in oil outnumbered short positions by 205,890 contracts at one point in mid-December. That should be a clear sign that investors do not expect the price of oil to go down any time soon.

#7 There seems to be an overwhelming consensus among oil company executives that the price of oil is going to go up in 2011. Joe Petrowski, the CEO of Gulf Oil and the Cumberland Gulf Group, recently told CNBC that “there’s 1 in 4 chance we’ll take out the $147 highs before Memorial Day.” John Hofmeister, the former president of Shell Oil, believes that American consumers could be shelling out 5 dollars for a gallon of gas by 2012.

#8 Many of the OPEC nations are indicating that they will be supportive of a rise in the price of oil in 2011. Mohammad Ali Khatibi, Iran’s representative to OPEC, said on Sunday that he expects to see 100 dollar oil very soon.

#9 The big investment banks are also expecting oil to soar in 2011. Goldman Sachs is projecting that the price of oil will reach 105 dollars a barrel next year, and JP Morgan is projecting that the price of oil will reach 120 dollars a barrel in 2012.

So what will it mean for U.S. consumers if the price of oil increases dramatically in 2011?

It will mean higher prices at the gas pump.

It will mean higher prices at the supermarket.

It will mean higher utility bills for most people.

In other words, millions of average American families that are already being stretched to the limit are about to be stretched even more.

That is really bad news for those families and it is really bad news for the U.S. economy.

Not only that, but many analysts believe that the dramatic rise in the price of oil in the summer of 2008 was one of the major reasons for the global financial collapse that happened a few months later.

Let us hope that such a thing does not happen again, but the truth is that world financial markets are so unstable today that virtually anything can send them tumbling at any time.

Without oil our economy would stop working and our entire society would shut down. The price of oil affects all of our lives every day even if we never realize it.

In 2011, the price of oil could become a really, really big story. It will definitely be something to keep a close eye on. If the price of oil goes too high it is going to start to create some tremendous imbalances in the global financial markets, and when financial markets become highly imbalanced they tend to crash.