The United States government will never have another balanced budget again. Yes, you read that correctly. U.S. government finances have now reached a critical “tipping point” and things are going to spin wildly out of control from this time forward. Why? Spending on entitlement programs and interest on the national debt are now accelerating at exponential rates. Some time around 2020 they will eat up every single dollar of federal revenue that is brought in before a penny is spent on anything else. Of course the solution to all of this would be to radically cut entitlement programs, but no U.S. politician in his or her right mind would do that. After all, do you think elderly people (who vote in droves by the way) would vote for you after you just cut their Social Security checks in half? That is not the way the world works. You see, democracies always get into trouble once the people realize that they can vote for the candidates that promise them the largest gifts out of the public treasury. That is where the United States is at now. Over 100 million Americans now receive direct payments from the United States government. For millions of Americans, the American Dream now means getting a government check and kicking back and enjoying life. We have become a nation that is chock full of people that can’t take care of themselves and that are totally dependent on the monolithic nanny state that the U.S. government has created.

The United States government will never have another balanced budget again. Yes, you read that correctly. U.S. government finances have now reached a critical “tipping point” and things are going to spin wildly out of control from this time forward. Why? Spending on entitlement programs and interest on the national debt are now accelerating at exponential rates. Some time around 2020 they will eat up every single dollar of federal revenue that is brought in before a penny is spent on anything else. Of course the solution to all of this would be to radically cut entitlement programs, but no U.S. politician in his or her right mind would do that. After all, do you think elderly people (who vote in droves by the way) would vote for you after you just cut their Social Security checks in half? That is not the way the world works. You see, democracies always get into trouble once the people realize that they can vote for the candidates that promise them the largest gifts out of the public treasury. That is where the United States is at now. Over 100 million Americans now receive direct payments from the United States government. For millions of Americans, the American Dream now means getting a government check and kicking back and enjoying life. We have become a nation that is chock full of people that can’t take care of themselves and that are totally dependent on the monolithic nanny state that the U.S. government has created.

Now, the truth is that helping the poor and those who cannot help themselves is always a good thing.

Nobody is denying that.

But are there really 100 million Americans that cannot take care of themselves?

Of course not.

The welfare state has gotten wildly out of control and now we are drowning in an ocean of red ink because of it.

In fact, unless the underlying laws for the entitlement programs are rewritten and unless benefits are cut to the bone, it will be mathematically impossible for the U.S. government to balance the federal budget from this time forward.

You are skeptical of that claim?

The following are 14 reasons why the U.S. government will never have a balanced budget ever again….

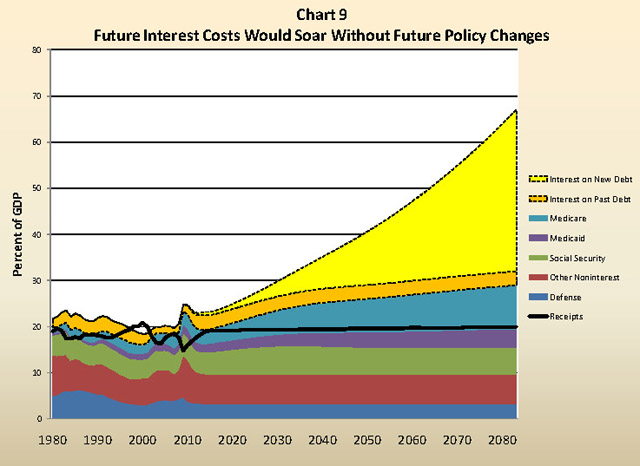

#1) Right now, interest on the U.S. national debt and spending on entitlement programs like Social Security and Medicare are somewhere in the neighborhood of 10 to 15 percent of GDP. By 2080, they are projected to eat up approximately 50 percent of GDP.

#2) Approximately 57 percent of Barack Obama’s 3.8 trillion dollar budget for 2011 consists of direct payments to individual Americans or is money that is spent on their behalf.

#3) Nearly 51 million Americans received $672 billion in Social Security benefits in 2009. That number is projected to grow substantially in years ahead as waves of Baby Boomers begin to retire.

#4) According to the Congressional Budget Office, in 2010 the Social Security system will pay out more in benefits than it receives in payroll taxes. That was not supposed to happen until at least 2016.

#5) Back in 1950 each retiree’s Social Security benefit was paid for by 16 workers. Today, each retiree’s Social Security benefit is paid for by approximately 3.3 workers. By 2025 it is projected that there will be approximately two workers for each retiree.

#6) The U.S. government “borrowed” 2.5 trillion dollars from the Social Security Trust Fund, and now it turns out that the Social Security system is going to start needing that money. So where will the U.S. government get an extra 2.5 trillion dollars?

#7) Over 40 million Americans are now on food stamps and the U.S. Department of Agriculture is projecting that more than 43 million Americans will be on food stamps by the end of 2011.

#8) Entitlement programs are not subject to budget freezes or budget cuts – unless Congress changes the underlying laws.

#9) The lobbies for those receiving entitlement payments are extremely powerful. That is why so few politicians will ever even mention the possibility of cutting Social Security payments. Old people vote in high numbers, and cutting their benefits would really piss them off.

#10) Interest on the U.S. national debt now makes up 7% of the budget and it is climbing rapidly. This is an expense that must be paid or else U.S. government finances collapse.

#11) According to the Tax Foundation’s Microsimulation Model, to erase the U.S. budget deficit for 2010, the U.S. Congress would have to multiply the tax rate for every American by 2.4. That would mean that the 10 percent tax rate would become 24 percent, the 15 percent tax rate would become 36 percent, and the 35 percent tax rate would have to be 85 percent. Keep in mind that this is before unemployment taxes, Social Security taxes and state taxes are paid. Do you think any American would ever put up with a federal income tax rate of 85 percent?

#12) According to an official U.S. government report, rapidly growing interest costs on the U.S. national debt together with spending on major entitlement programs such as Social Security and Medicare will absorb approximately 92 cents of every dollar of federal revenue by the year 2019. That is before one penny is spent on anything else. As the U.S. government graph below reveals, the financial picture only gets more bleak in the years beyond that….

#13) The present value of projected scheduled benefits exceeds earmarked revenues for entitlement programs such as Social Security and Medicare by about 46 trillion dollars over the next 75 years. So that means that the U.S government is going to have to find an extra 46 trillion dollars from somewhere to pay all those benefits.

#14) The vast majority of the American people have become soft and don’t know how to take care of themselves any longer. We now have millions upon millions of people who are totally dependent on the U.S. government for survival. As the government takes care of more and more people the red ink will increasingly get worse. At what point will it cause U.S. government finances to totally collapse?

Needless to say, the U.S. government is facing a financial crisis that is absolutely unprecedented in U.S. history. There is no way out of this mess that does not involve a massive amount of economic pain.

As of June 1st, the U.S. National Debt was $13,050,826,460,886.97. But as you can see from the data above, things are about to get a lot worse.

We are heading into a financial black hole that will literally rip apart this nation if something is not done right now to fix things. But the folks down in Washington D.C. don’t seem the least bit interested in fixing things. In fact, about the only thing they seem determined to do is to spend even more money and get us into even more debt.

The course we are on now can only end badly. Hopefully our representatives in Washington D.C. will wake up while there is still time. If not, the tsunami of red ink that is headed our way will devastate all of our lives.