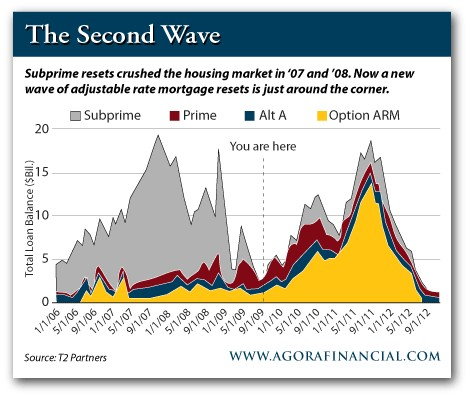

The U.S. economy has been riding out one of the worst recessions in modern history, but unfortunately every economic signal seems to be indicating that we are going to be experiencing a “double-dip” recession instead of a recovery. U.S. government debt is out of control, a massive “second wave” of mortgages is scheduled to reset starting this year, banks have significantly tightened credit, pension funds across the U.S. are broke at a time when a ton of Baby Boomers are ready to retire, and a massive financial crisis in the Eurozone threatens to throw the world into financial chaos. The truth is that 2010 is going to be another very tough year economically, and for many the American Dream is quickly becoming a distant memory. The following are ten clear signs that this will be a double-dip recession in the United States….

The U.S. economy has been riding out one of the worst recessions in modern history, but unfortunately every economic signal seems to be indicating that we are going to be experiencing a “double-dip” recession instead of a recovery. U.S. government debt is out of control, a massive “second wave” of mortgages is scheduled to reset starting this year, banks have significantly tightened credit, pension funds across the U.S. are broke at a time when a ton of Baby Boomers are ready to retire, and a massive financial crisis in the Eurozone threatens to throw the world into financial chaos. The truth is that 2010 is going to be another very tough year economically, and for many the American Dream is quickly becoming a distant memory. The following are ten clear signs that this will be a double-dip recession in the United States….

#1) A massive “second wave” of adjustable rate mortgages is scheduled to reset beginning this year. If the first wave brought the U.S. housing market to a standstill, what will this second round do?

#2) Recent data suggests that there has been a substantial drop in the “real” M3 money supply, and every time that this has happened in the past it has resulted in a drop in economic activity.

#3) The number of Americans who have gone bankrupt is absolutely stunning. 1.41 million Americans reportedly filed for personal bankruptcy in 2009 – a 32 percent increase over 2008. Until this number gets turned around, there simply is not going to be any kind of recovery.

#4) A massive wave of Baby Boomers is on the verge of retirement and this threatens to put even further pressure on the financial system. In fact, some analysts are now forecasting that Baby Boomers are going to bankrupt the entire Social Security system.

#5) According to the National Association of State Workforce Agencies, companies in at least 35 states will have to fork over more in unemployment insurance taxes this year. This will hurt small and mid-size businesses especially and will discourage them from taking on more workers.

#6) The U.S. government continues to recklessly spend money like there is no tomorrow, and while that may help stabilize things in the short-term, the truth is that the long-term debt problems of the United States government continue to get worse.

#7) In fact, the U.S. government is doing all of this spending at a time when tax receipts are falling off precipitously. U.S. corporate income tax receipts were down 55% in the fiscal year that ended on September 30th, 2009.

#8) The United States is faced with a pension crisis that is absolutely mind blowing. Virtually all pension funds in the United States, both private and public, are seriously underfunded. With millions of Baby Boomers now on the verge of retirement, there is simply no way that all of these pension obligations can be met. Robert Novy-Marx of the University of Chicago and Joshua D. Rauh of Northwestern’s Kellogg School of Management recently calculated the collective unfunded pension liability for all 50 U.S. states for Forbes magazine. So what was the total they came up with? 3.2 trillion dollars.

#9) There is talk that the economic crisis in Greece will throw the globe into an even deeper recession unless something is done right away to address the problems. Much of the Eurozone is a financial basket case right now, and that could make it much harder for the U.S. to have any kind of lasting recovery.

#10) Many Americans are incredibly discouraged. The economic downturn is causing a sharp rise in the number of Americans that are going hungry. In fact, more than one out of every 10 Americans is now on food stamps. Unemployment is estimated to be up around 45 to 50 percent in places like Detroit. Meanwhile, all the recent polls indicate that Americans are getting angrier at the government than ever.

Americans need hope, but hope is in short supply these days.

It looks like it is going to be a rough ride ahead.